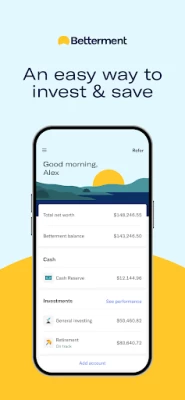

Betterment Invest & Save Money

June 30, 2024More About Betterment Invest & Save Money

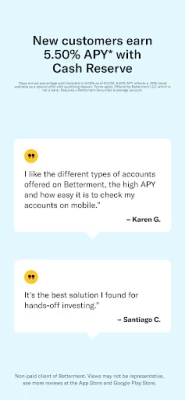

NEW CUSTOMERS EARN 5.50% VARIABLE APY* (as of 4/2/24) ON CASH

- Get an extra 0.50% APY* with qualifying deposit and over 11x** the national average.

- Protect your earnings with up to $2 million† in FDIC insurance at our program banks.

- Learn more at betterment.com

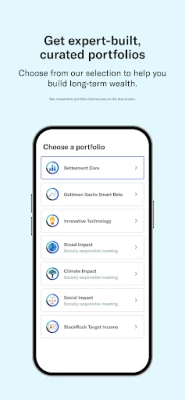

WEATHER ANY MARKET WITH EXPERT-BUILT PORTFOLIOS

- Customize your stock-and-bond risk level with recommendations from the pros.

- Choose one of our optimized, curated portfolios of ETFs, like Innovative Tech, Goldman Sachs Smart Beta, or socially responsible investing options: Broad, Social, or Climate Impact portfolios

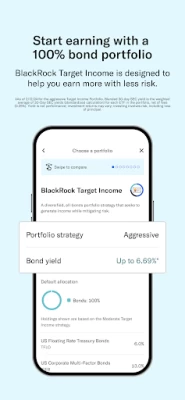

- Looking for an all-bond strategy? Try our BlackRock Target Income portfolio to earn higher yields than cash while taking on less risk than stocks.

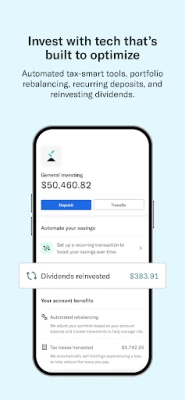

INVEST WITH TECH THAT OPTIMIZES FOR YOU

- Rebalance your portfolio and reinvest dividends automatically

- Limit your tax impact with automated tools, like tax-loss harvesting and tax coordination between accounts

- Set up recurring deposits on your preferred schedule

- Questions? We’ve got resources galore or ask our financial advisors!

KEEP MORE OF YOUR MONEY

- Invest with us for just $4/month, or pay an annual fee of 0.25% on your investing account balance when you:

- Have a total Betterment balance of $20,000 or more across any accounts you hold at Betterment, or

- Set up a recurring deposit(s) of $250/month or more into any account

- Upgrade to Premium for unlimited access to advisors at just .4% of your invested assets, a fraction of the cost compared with traditional advisors

- These are CERTIFIED FINANCIAL PLANNER™ professionals, salaried never commissioned, for a significantly lower management fee

TURN LIFE GOALS INTO MONEY GOALS

- Save for that exercise bike, your next vacation, and more

- Go beyond your 401(k) with an IRA

- Use our projection tools to create a plan

- Calculate how to reach your target with our goal forecaster

SEE THE BIGGER PICTURE

- Get our all-in-one financial dashboard

- Connect outside accounts, see your net worth, and view your investment performance, all in one place

GET MORE WITH BETTERMENT

- Crypto Investing with diversified expert-built portfolios and in-depth resources

- Manage money for everyday spending with Checking

- Retirement planning with a 401(k) plan for your business

______________________

Betterment

8 W 24th St., New York, NY 10010

**National average savings account interest rate is reported by the FDIC (as of 3/18/24) as the average annual percentage yield (APY) for savings accounts with deposits under $100,000.

Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank.

While bonds are substantially less volatile than stocks, investing in bonds is not without risk.

Digital assets are highly speculative and volatile, and only suitable for investors able to bear the risk of loss and sharp drawdowns. Digital assets are not legal tender and not subject to FDIC insurance or SIPC protections.

Latest Version

8.68.0

June 30, 2024

Betterment

Finance

Android

890,897

Free

com.betterment

Report a Problem

User Reviews

Glen Larkins

3 years ago

After enabling fingerprint authentication the app will occasionally sign me out. Why? Forcing me to get the password and use it after setting up a biometric isn't making the app more secure. Edit to reply: That's the issue though, I haven't logged out completely. I'm assuming an upgrade to the version may have caused it. I would completely understand if I had logged myself out but that's not the case.

A Google user

5 years ago

It's a decent app but it's missing a lot of features that are on the website. The biggest problem with this app is the timeout. Once I exit the app or switch to a different app, it logs me out. I would like the app to have settings where I can adjust the timeout to keep me logged in for 5 mins or 15 mins or 30 mins or 1 hour etc. I hate having to log in every single time. It gets very annoying.

Negar Tabibian

5 years ago

I really enjoyed the app in past years, the updates and design is helpful. Yet since couple of days ago, the app started being broken and then kicked me out all together and doesn't let me in anymore. (I uninstalled and reinstall the app already. No change.) My credentials are right, since they work on the website, but the app doesn't work.

Kody Scalzi

4 years ago

Great app and experience using it. I wish there were more options for push notifications. I would like to be notified when there is a debit or credit on my checking account. Having few notifications was great when I was just using the app for investing, but checking accounts need more active monitoring and the app is lacking in that area.

A Google user

5 years ago

Easy to use, easy to understand, easy to link to my other bank. Got the checking account with debit card. It really does reimburse ATM fees. Also, there are NO hidden fees. There are no fees at all for checking and savings. Only reason I'm still using my other bank is for immediate access to cash, but for savings: Betterment. I don't make a lot of money so the option to invest or save small amounts at a time is just nice.

Shae Reub

3 years ago

I recently had my account suspended for suspicious activity. As it turns out, it was because the Yotta account I have, I can't transfer into taxable accounts (only 1 checking account I sync up). So I called customer service explained the situation, and got my account unlocked. Their email system is good too. While they don't give direct advice, they will link a page that has more info on the topic that does have suggestions with certain situations. They make it easy to Set it & forget it too.

A Google user

5 years ago

Easy to use and Easy to understand. I had a problem linking one of my accounts to make a deposit, but after an email, they fixed it and extended their promotion so I could make the deposit and service free for a year. Great and quick customer service. Only thing that would be better is if we could invest in individual stocks too, but the returns it has made in short time during current situation. No problem with me. Definitely recommend to friends

A Google user

6 years ago

App won't open. I have had a consistent issue with getting the app to open. Whenever I contact customer service about this issue, it takes around 48 hours for a response that tells me to have the latest version of the app installed, which I do. I have contacted customer service multiple times about this and they of no use in solving this issue. It's a shame because Betterment provides a good service.

A Google user

6 years ago

I am a big fan of this app. I like that there a very minimal fees and no deposit or withdraw fees. It's very easy to set up a small (or large) reoccurring deposit from each paycheck into multiple accounts and watch them grow with nearly no effort on my part. It is also nice to have some of my money slightly separate from my traditional accounts as i often get tempted to dip into my savings when i didn't stick to my budgeting for the week. Overall, I would recommend Betterment.

Bex

4 years ago

Am okay with the services as a whole, but the app regularly has issues. Both the app and website feel like beta versions, bare bones and unintuitive. Navagation lacks natural redundancies, as in 'you can't get there from here' and the ability to see some data side by side with another. Statements are all stored PDF with no fully online scrollable viewing, strange for a web based business. This isn't a finance company that modernized into online & app services, it's the whole business model.

A Google user

6 years ago

Betterment as a service is extremely simple, but to be honest I haven't seen any returns in 2 years of passive investing with an auto-adjusted portfolio. App itself is pretty good. Works for seeing an overview of your investments & making deposits/withdraws. Not great for adding/managing external accounts. No Robinhood support. No ability to transfer money between taxable and joint taxable accounts. Also very, very white. Please make a dark theme.

Robert

5 years ago

I was originally drawn to Betterment's no fee checking and cash-reserve accounts. Unfortunately they've made linking external accounts a pain. The biggest issue is that they won't recognize my other checking account as a "deposit" accounts. The account will display as a checking account and show the amount held, but you can't do anything with it. I can't recommend a banking service that makes it so hard to move money.

Terry Carter

3 years ago

I installed the app on a recommendation. Few minor issues in the beginning no problem. Now here comes the major issue. The email address that I used to set the account didn't work (credentials have expired?).So I changed the email address (same issue credentials have expired). So I tried logging in using the second email address. This email address is already being used. Why am I having to change email addresses? This app is starting to really annoy me

Lindsay Johnson

5 years ago

Nice app, easy to use. I don't like that you can see my app screen when I am switching between apps. My mint app, for example, shows a white screen when I navigate away from it. Betterment needs me to put in a password to access the app again, but I can read the screen and see everything before I out the password in when I navigate back to it (if thdt makes sense?) Would prefer it to go blank.

Brandon Frye

5 years ago

App is so confusing. The layout is cluttered and disorganized. Not to mention the difficulty in transferring funds between your checking and Cash Reserve accounts. You can transfer money to the other account by going to either account, and selecting "transfer". You can also go to that account and there's a "deposit" option, which does the same thing. So... 3 ways to do the same task. But only for certain tasks. Otherwise the app is stable and works as designed. The design just needs tweaking.

Victor M

5 years ago

The app works well, no complaints in a vacuum. But compared to the desktop site, the app is extremely limited! And does not make it clear what you can only do on the desktop version. It's fine for peeking in on your portfolio and minor adjustments but largely lacking vs the full site. Also, a major general improvement to Betterment would be being able to keep auto adjust on while changing risk settings +/- a few degrees up or down.

Lane Price

4 years ago

The app is clean, easy to use. I'm able to set up an automatic deposit, check my balance, account performance, etc. I had a question a while ago, and ngl i was on hold on the phone for a while until i gave that up and emailed them. To my surprise they were very punctual in replying back and extremely courteous and helpful. So phone isn't the best but customer service was great over email, overall positive experience so far.

Rafael Couto

4 years ago

Very limited list of external accounts to be synced automatically, manually updating accounts is a pain. Can't project future value of multiple goals together, only each goal individually. Would love to project my future net worth as an individual, not just for each goal. Now, recently, for some reason, the app only shows investment accounts, I can't see the balance of my external cash and credit accounts, forcing me to have to use my computer

Kyle Murdock

1 year ago

I give it 4.5 stars. I really like how intuitive and easy it is to use the app. There are many notes that explain everything! You can see deposits, withdrawals, total gain/loss, net gain/loss, total percentage gain/loss, annualized percentage gain/loss, tax documents, etc. I almost always gain and the automatic management fees are a very low percentage (probably about 1%). My only problem is that it is hard to find where to change the investment percentage stocks and percentage bonds.

astrid soulette

1 year ago

So hard to get to the individual account balances. First page should reflect accounts and balances with hyperlinks to get the transactions within the account. Instead it bundles the accounts. Super NOT user friendly. I don't know why it reflects balances from my bank of america. It shouldn't, period. Getting frustrated and may end up closing and moving to a more user friendly application. It's a shame since this is an online bank.