YNAB

July 13, 2024More About YNAB

You need a set of habits to change your mindset and your behavior, until you are spending purposefully, saving aspirationally, and even giving generously.

YNAB has taught millions of people a set of habits to change their relationship with money for good. As these habits become second nature, you’ll stop fighting about money, make better decisions, and sleep better at night. Confident, secure — are you ready to feel this way about your money (and so much more)?

Start your one-month free trial today!

Key Features:

Built for Partners and Families: A close-knit group of up to six people can share budgets (and dreams!) at no extra cost.

Manage your Loan Payoff: Tackle debt by calculating the time and interest saved with every extra dollar paid.

Expense Tracking: View changes to your budget in real time to simplify sharing finances with a partner.

Goal Setting: Turn your dreams into categories, set spending targets, and visualize your progress as you go.

Credit Cards: You'll always know whether you can pay off your credit card balance. If not, we'll help you make a plan to get there!

Import Income & Expenses: Add transactions manually or securely link accounts to view your big financial picture in one place.

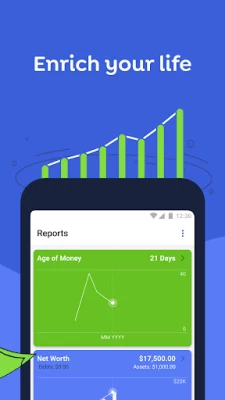

Spending & Net Worth Reports: See your spending averages (down to the cent) and your growing net worth in full technicolor glory by slicing and dicing your data.

Privacy Protection: We don't (and won't) sell your data. We don't host in-app ads or pitch recommended products. It’s never been our thing. Ew.

Resources Galore: Our award-winning support team is eager to answer your questions and a wealth of free resources, including live workshops, video courses, written guides, and more.

Love how you spend and celebrate how you save. YNAB and its simple set of habits will help you spend purposefully, save aspirationally, and even give generously.

How do you want to spend your money, or more importantly, your life?

Free for 30 Days, Then Monthly or Annual Subscriptions Available

You Need A Budget UK Limited is acting as an agent of TrueLayer, who is providing the regulated Account Information Service, and is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 (Firm Reference Number: 901096)

Terms of Use:

https://www.ynab.com/terms/?isolated

Privacy Policy:

https://www.ynab.com/privacy-policy/?isolated

California Privacy Policy

https://www.ynab.com/privacy-policy/california-privacy-disclosure/?isolated

Your Privacy Choices

https://www.ynab.com/privacy-policy/opt-out-request/?isolated

Latest Version

24.11.1

July 13, 2024

ynab.com

Finance

Android

2,592,058

Free

com.youneedabudget.evergreen.app

Report a Problem

User Reviews

Andréa Withrow

1 year ago

not as robust or as good as The web app. when paying off my credit card I have to go to the web app because I can't find the category and the phone app. otherwise this is fantastic. I've been able to accurately pay so many bills, and plan for surprises. I've only been using this since February (two whole months) and it's been a game changer. I came from mint and mint was really not good at helping me save money, just tracking money, so less of a budgeting tool and more of a tracking tool.

Jordan L

1 year ago

Just started. Not sure if we'll continue. The UI is terrible. Super noisy. Mobile is worse. There is no way to navigate directly from the budget view (Gas, Bills, etc...) to the transactions currently mapped to that budget category. This seems like a budgeting tool basic. Users should always be able to navigate up and down, that is, go from a higher level category and drill all the way down to he transaction. Adding users to my budget requires them to also pay for a YNAB subscription?

Shreyas Patil

1 year ago

It is a little intense. Persevere through it and a healthy future awaits. It is easier if you single doing one budget for yourself. You have to think a lot harder if it is a household budget you plan to share with a partner. It forces you to think where your money is going. As for the app. The team has worked really hard to make the app as easy as possible. The support staff is very helpful to walk you through your problems. A+ support, not just app but also web. We have had multiple sessions.

Dwight Ferris

1 year ago

This is the only budget app that actually works for us. It's a digital envelope system and it makes so much easier manage a budget between two people. This app allows us to assign every dollar a job, helps keep track of annual subscriptions so we are not taken by surprise, and safely use credit cards. Be sure to watch the setup video it is very very helpful. Budgeting requires constant attention to your money and every purchase. This app allows multiple people do just that. Worth every penny.

Jessi David

1 year ago

Great concept, mediocre execution. The app and website honestly are way behind the times based on features, so you're not paying for anything special except permission to use the concept. 🤷🏼♀️ I like the concept but I won't be renewing unless they catch up with their app and website. At least make it easier to use and have all features transferred seamlessly. The app is more difficult to use than necessary.

Ted Kunhardt

1 year ago

It takes some getting used to, but I wouldn't use ANY other budgeting app. It's impossible to go over budget with the methodology. Everything syncs and rolls up clean (even if you don't understand why at first). Makes you think about money differently. I believe the methodology is rooted in double entry accounting, but it's woven into how the app calculates your transactions and presents the money you have left. Fantastic!

Anthony Friday

1 year ago

I'm not a huge fan of the allocating system, especially with credit cards and tracking internal payments from one account to another. It does sync up nicely and allows me to see my spending better. I also don't like that it carries forward positive money in a category but not a negative.

Internet Psycho

1 year ago

It's a good budget app. However, it lacks the ability to stay up to date with bank information. My bank transactions have been delayed for more than 2 weeks, and I am not gonna sit and write it in, just for them to filter through and be forced to categorize them again. It is also confusing, and I had to watch a YouTube tutorial on how to approach it. It's def a great starter app, but I won't be using it for long.

Aaron Zick

1 year ago

Today I really felt the mind shift that comes with YNAB - I hate buying things because I hate racking up debt, even as an active budgeter. I bought some shoes and just knew money was allocated for it. And I'm working towards being a month ahead on bills. It did take me a while to wrap my head around the mental model (esp with credit cards) but there are a lot of free resources and community that have helped, and YNAB has streamlined a lot of things. I was a decades long Excel devotee, no more!

Jennifer Haley

1 year ago

I have enjoyed YNAB for budgeting. But because I was trying to lessen my bills I loved the free version. I didn't need to have my bank linked. It saddens me to see everyone getting rid of free versions. When I could have afforded to, I would have paid on my own for the paid version so I could contribute to others being able to use the free version and get on top of their finances. But, I am now having to pay for the full version and no longer feel that they have our financia goals in mind.

J carroll

1 year ago

This is a great app to determine your monthly budget. However, once you do that it doesn't offer much else. It doesn't track your expenditures and how much money you have. Also if you link a bank account it doesn't show pending charges against your balance so you really don't know truly how much money you have left. Again it's a great app to determine your budget but doesn't do much else and I don't think it's worth the high monthly fees. And, as others have mentioned not very intuitive.

N S

1 year ago

Using this app is so incredibly frustrating. I absolutely love the idea, but the functionality of the app is poor. Every step of the way something went wrong and I had to find a workaround. I finally gave up after I tried to assign money to a category only to have it debit the category instead. I fixed it and tried again three times, being very careful with how I was doing it, trying different ways... No luck. I'm done.

Warren Teachout

1 year ago

YNAB and its 4 rules have completely changed my relationship to money. When I started using it 3 years ago, we had multiple credit cards with balances we carried over each month. We will be completely free of all credit card debt soon! We have money in the bank for car maintenance, vet bills, Christmas and other gifts, vacations, etc. because we know our true expenses. It feels amazing to pay those things in cash. Thank you YNAB!

Jessica Doud

1 year ago

YNAB is such a good budgeting tool. For a reasonable yearly subscription, I finally have a budget that I can stay on top of that makes sense, with all my bank accounts linked to automatically import transactions quickly and easily. The app is continuously improving - I chatted with a support agent about how I was struggling to track a specific part of my budget and a few months later the app got updated with the exact things I had asked for. I would highly recommend YNAB to help with finances.

Cara Anderson

1 year ago

I've been using YNAB for over a year now and it's the best app I've been able to find so far. It does have a steep learning curve though, and there are still things that I have asked support about multiple times and don't understand why they don't work in a way that makes sense to me. Maybe it's mostly user error, but it sometimes seems to be more UX-oriented rather than UI-friendly. It would help if there was a more built-in tutorial/explanations of how each element/action works

Nate Zimmerman

1 year ago

The more I used it the more confusing it got, but this might just be harder when trying to budget for 2 people on a single account. The UI doesn't really explain why the budget bars are divided and the credit card payments are very difficult to categorize on mobile. I can spend the same amount of time just using an excel sheet.

Ian Adams

1 year ago

It is by far the best budget app I've used. I've been using it for years now. Best feature is, most budget apps will simply go into the red for a line item. But still let you think you have enough in another budget. But you don't, since you're in the red. YNAB encourages you to move money to keep things out of the red. I was able to easily onboard my wife when we started sharing expenses. Price for a year is respectable. I don't see myself ever using anything else.

Shane McCarron

1 year ago

my only complaint is that the mobile app won't show account balances. What I mean by this is a running balance of each account, including projected future balances. For example, when you view a checking account it will show all the past transactions, pending transactions, and scheduled transactions. It will NOT show what the balance changes to with each of these transactions. The web app does this, but it would be REALLY helpful on mobile.

Patrick Seiter

1 year ago

I created a "Line of Credit" instead of a Credit Card for an installment plan that I pay off every month, and now I can't delete it or remove it from the app at all. If I commit money to a category on accident I cannot undo it. I'm not moving real money around so I don't understand why this app prevents me from undoing literally anything. I can't even rename a connection once it's been created unless I delete and recreate it (I want to put the date that my credit card is due in the title).

Rachel Golden

1 year ago

Great app, they are always working on improving it, and excellent customer service. I had an issue with an account syncing but they got me fixed up. There are many knowledgeable people who explain how YNAB works on YouTube and there is also a Facebook group. This is the money/budget app I always wanted but didn't know existed. The app syncs with the website so I can access it anywhere and my husband can too. Has helped me change my mindset on budgeting, spending, and saving in many good ways.