Walmart MoneyCard

June 12, 2024More About Walmart MoneyCard

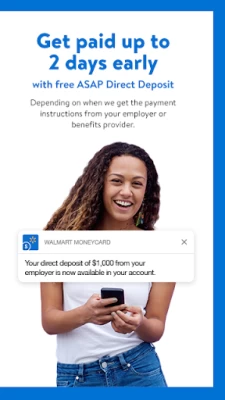

Get your pay up to 2 days early with direct deposit. ¹

Earn cash back. 3% on Walmart.com, 2% at Walmart fuel stations, & 1% at Walmart stores, up to $75 each year. ²

Share the love. Order an account for free for up to 4 additional approved family members ages 13+.³

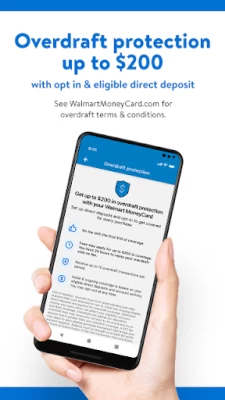

Get up to $200 overdraft protection with opt-in & eligible direct deposit. ⁴

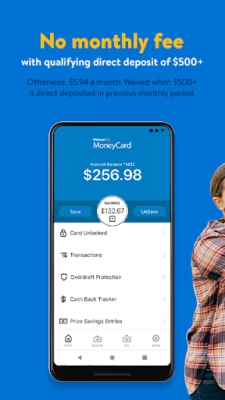

No monthly fee with qualifying direct deposit of $500+. Otherwise, $5.94 per month. ⁵

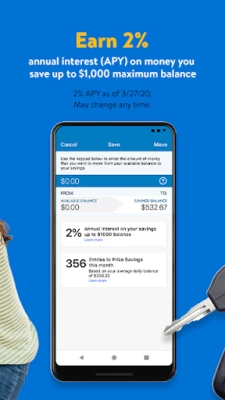

Earn 2% interest rate on savings.⁶

Lock protection in the app. Misplaced card? Press LOCK to prevent purchases. Press UNLOCK to restore it instantly. ⁷

Use it for purchases everywhere Debit MasterCard® or Visa® debit cards are accepted in the U.S.

NO minimum balance or credit check to get a card today.

EASY WAYS TO MAKE DEPOSITS:

Direct Deposit your pay or government benefits.

Add money to your card from your existing bank account.

Free cash reloads with app at Walmart stores nationwide.

Deposit checks using your smartphone

Questions about your Walmart MoneyCard?

Log in to walmartmoneycard.com & email us, or call us at the number on the back of your card.

Must be 18 or older to purchase a Walmart MoneyCard. Activation requires online access and identity verification (including SSN) to open an account. Mobile or email verification and mobile app are required to access all features. See account agreements for fees, terms and conditions at https://www.walmartmoneycard.com/account/legal-info

1. Early availability of direct deposit depends on timing of payor's payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

2. Up to $75 per year. Subject to eligibility. Redeem rewards upon each anniversary of opening the account, using our website or app. See Deposit Account Agreement for details.

3. Activated, personalized card required. Other fees apply to the additional account. Family members age 13 years and over are eligible.

4. Opt-in required. Account must be in good standing and chip-enabled debit card activated to opt-in. Initial and ongoing eligible direct deposits are required for overdraft coverage. Additional criteria may apply which can affect your eligibility and your overdraft coverage. Overdrafts are paid at our discretion. Overdraft fees may cause your account to be overdrawn by an amount that is greater than your overdraft coverage. A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. Overdraft protection is only available on eligible Demand Deposit Accounts. Log into your account and refer to your Account Agreement to check feature availability.

5. Monthly fee waived when you direct deposit $500+ in the previous monthly period. Otherwise, $5.94 a month.

6. Interest is paid annually on each enrollment anniversary based on the average daily balance of the prior 365 days, up to a maximum average daily balance of $1,000, if the account is in good standing and has a positive balance. 2.00% Annual Percentage Yield may change at any time before or after account is opened. Annual Percentage Yield is accurate as of 3/1/2022.

7. Monthly fees will continue on locked cards. Learn more in the Walmart MoneyCard app.

ATM access only available on personalized cards. Other fees may apply. Visit walmartmoneycard.com for more info.

Technology Privacy Statement: https://www.walmartmoneycard.com/content/dam/walmart-moneycard/legal/privacy-site-terms/Privacy%20Policy.pdf

Card issued by Green Dot Bank, Member FDIC, pursuant to a license by Mastercard International Inc. and Visa U.S.A., Inc.

Latest Version

1.52.0

June 12, 2024

Green Dot

Finance

Android

5,250,922

Free

com.greendot.walmart.prepaid

Report a Problem

User Reviews

Chuck Powell

4 years ago

This app has worked great from 2014 until the last year or so. I have a new model Samsung S21 and it does not work so great now. I have trouble at the 'Loading' screen after I verify my identity. It just flashes the 3 dots endlessly 2 out of every 3 logins. Other than that, the app has always been very well set up and straightforward. Other than the loading problems, it has been very good to me.

Robbie Thornton

2 years ago

This app continuously gets stuck on "loading" when you first open it up, and then when you try to change pages. This has never happened before, and this last update, which was forced, seems to be a problem for everyone. Whatever the bug is, it needs to be fixed. The hassle isn't worth it anymore. Do not download until there's an update newer than April 06, 2023. Newest update for May 22, 2023 is worse. Now balance and savings do not show at all in app. Only way to see balance is the slider.

Cheryl Howard

3 years ago

It's great in a lot of ways. I love that you can move money to save. You can have checks to write and use an routing number and account number to save money on paying your bills. I don't loke the fact that to call they hide the number under the forgot login link. I also do not like the fact they hold my photo deposits for a whole week before making them available.

David Norman

4 years ago

works great! was my previous post. Now I've found a problem a Walmart charge for some reason was posted twice with a 2 cent difference, so I still have the incorrect amount showing pending. Thier customer service is the worst, they will just not talk and then hang up. The other problem with the app is that it doesn't show a balance on the register. If you go to their website you can see the balance after every transaction. Why they don't do that way on the app is beyond me.

A Google user

5 years ago

Have very few problems with this card. I've read the other reviews, most are user error. Not the card. I've had it over 2 years. I dont have my apps on auto update so I have to go in an update myself. If I wait to long Walmart Card will send me an email just to remind me. I use the lock feature all the time, and live it. Only issue I've had is poor internet will make the app fail to load properly or not allow for me to unlock my money. And again this is not the app's fault that the internet where I am is slow or down.

Amanda Miller

2 years ago

Desperately needs an update! I have always loved my account. Super easy and convenient. However, since the last update the app is almost useless! Takes forever to load then doesn't show all transactions. I am unable to move money to the vault because it never loads up. Plz fix soon! Haven't been able to log in on browser either!! Have had this issue for 2 months now!!

Amanda Alarcon

3 years ago

App is very user friendly & easy to use/navigate through. Keeps me updated with every transaction posted immediately. I love the simplicity while it also is secure & accurate. Only issue I have is $5 monthly fee & especially the ridiculousness of being charged $3 to put money on MY OWN ACCOUNT! As well as it having to be minimum of $20 to load on your own card. I think that is so wrong. Only time I've ever even heard of being charged to put money on own account. Besides that app is great.

Melissa Anderson

2 years ago

I have used this app and this card for 10+ years and these last few months have been the worst. 10 times I logged into the app and can't get past the loading screen then if and when I do get into it I can't see my balance unless I click to save or unsave money. But dam don't expect to get back to the home screen cause then it starts loading again and that's all it does. It's getting old and there is no reason for it other then pure laziness on the developer. Get it together guys!

Maria Geuss

2 years ago

ZERO STARS! I've been using this app for a few years, but for the last few months, it won't show balances. The app sometimes won't let you log in. Finally, when you do get logged in, you can't even transfer money from savings to available as it only gives notice that there is a problem and to try again later. I will be switching to Chime or something else because, at this point, I even use my money or see what's in there.

Kathryn Cumberland

5 years ago

Removing the ability to send PayPal via the app was a HUGE mistake! I also can't use my routing/acct #s to use the banking option. I have to use the card option, which costs more. I like the ability to receive my paycheck two days early, but when I switched companies, sometimes it'll pay me one day earlier, sometimes on payday, sometimes even a day or two late! I'd rather it just be on time than to never know when I'm going to get paid. Paying at the pump is often a hassle or won't work at all.

A Google user

6 years ago

Not all features available. Mobie check deposit is no where to be found on the app, even though it is shown right on the front screen when trying to download. Please fix this asap. I get paid in handwritten checks from time to time, and it's very difficult to deposit them onto my walmart card without paying extensive fees. This issue has not been resolved in 2 years

A Google user

6 years ago

For the most part the app works great. I've used it for a few years now and haven't had any problems, except on Sundays where it sometimes won't let me log in. But now that I have a Galaxy s10, the app will not let me save my fingerprint. It keeps saying that I need to enter my password, but then goes right back to the register fingerprint screen. It may have a bug, cause it's stuck in that loop.

A Google user

6 years ago

The latest update got worse. Now it often says my phone time is incorrect, and when I choose to continue anyway, the transaction goes through, but never shows on the balance. I have to close and reopen the app each time to reflect the balance. And my phone time is always correct, auto updated from Tmobile. It's a bug in this app. Please fix.

John C

2 years ago

I discovered that my security software was blocking my access from accessing the App on phone, I thought everything was then fine. But recently discovered that Wal-Mart's efforts to enter into the payment platform included a monthly fee. With so very many options available for no or limited charges, I went ahead and closed the account today. Don't take it personally, Walmart, but even with the lil bit of interest compounded, for me it's just not worth it. Do correct me if I'm mistaken!

kolten (Bakenbeans420)

3 years ago

My experience with this app has been great. Been using it as my main form of banking for 2 years. Never had any issues. My card did get locked once but all I had to do was call and clear up the misunderstanding. But ya other than that its good. I dont like the $2.95 monthly charge but its whatever. Its 3 dollars. Not putting a dent in my wallet. Anyway ya, been 5 stars. I especially like how you can switch money from the checking to savings through the app on the go.

Lisa Carter

2 years ago

I've had my card and app for about 10 years or more. I've never had any major issues with it. That's why I've had it so long. I do love the "save" feature so that I don't accidentally spend bill money. I'd give this app 5 stars again if you'd please fix the slide balance feature! I've never had issues with it till the last few months. It always updated almost instantly, but now it rarely updates until I log into the app. Fix this feature, and I'll go back to 5 stars! Please!!

Dawn Mercado

1 year ago

Trash. The list is so long but I'll start with the fact that transactions don't match date and time, balance shown is not always real balance n it takes forever for deposits to show n can't use the money! Now, I was missing $650 from savings n it didn't even show that I ever had the money!! Customer service is absolutely worthless! Everytime I called I got a different story, even some insinuating that I was lying! 6 days later it reappears n I'm stuck with late fees from all my bills being late!

Brittany McCue

1 year ago

Walmart MoneyCard offers a convenient way to manage finances. Its user-friendly interface and features like direct deposit and mobile check deposit make it easy to access funds. However, occasional glitches in the app and customer service response times could be improved. Overall, a reliable option for those seeking a prepaid card solution.

Anthony Damman

1 year ago

If I could give a zero star rating I would. The app can only be used if I'm on my data. If I'm using WiFi, it will show the loading dots and keep showing them until I turn my wi-fi t. The app constantly crashes. It tells me 4-5 times that the app has log in issues and to try again later. No matter how many times I've updated the app, nothing is fixed This has been going on for about a year or longer now.

Charlotte Bowers

1 year ago

I've had the exact same card/account for 6 + years. So far, no problems. I'm hoping this "update" doesn't screw everything up, as random updates are so often a disaster waiting to happen. Latest update 4/21/24? The app opens, shows my balance, but I'm unable to do anything else. Can't check transactions, main menu won't drop, can't move money in or out of o line vault. Unfix it. It was working fine.