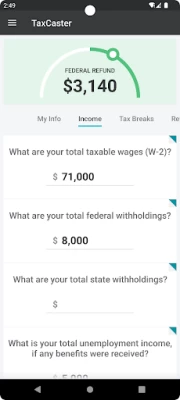

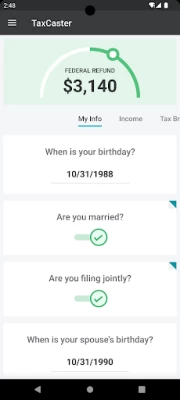

TaxCaster by TurboTax

July 06, 2024More About TaxCaster by TurboTax

• Up-to-date: Updated to 2023 tax laws for an accurate tax refund estimate.

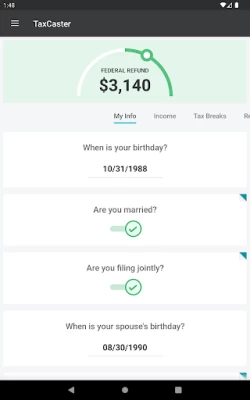

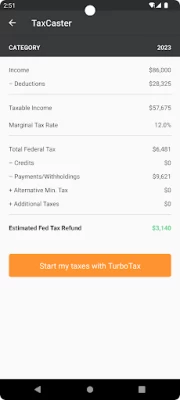

• Know your taxes: Use an estimate from the federal income tax calculator to get a quick read on your taxes before you prepare your tax return.

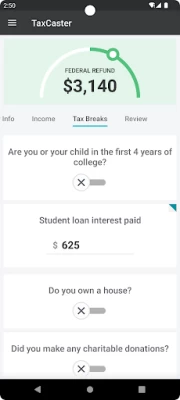

• Plan ahead: Run scenarios on life events like getting married, having a baby or buying a home. Adjust your paycheck withholdings so you take home more money or plan ahead so you pay less tax.

• TaxCaster en Español: If your device language is set to Spanish, the app will default to the Spanish setting. You can also override the default/change the language in the app settings.

• Family of apps: Navigation drawer that lets you easily switch to other Intuit apps: TurboTax and Mint.

To learn how Intuit protects your privacy, please visit: https://security.intuit.com/privacy

Intuit has offices worldwide, and is headquartered in Mountain View, 2700 Coast Ave, Mountain View, CA 94043

DISCLAIMERS

• NOTE: TaxCaster doesn't prepare your taxes. You can use it to estimate your taxes, and then use TurboTax to prepare and file your taxes.

• TaxCaster and TurboTax do not represent any government entity. The websites for the IRS: https://www.irs.gov, as well as state & local tax authorities: https://ttlc.intuit.com/turbotax-support/en-us/help-article/state-taxes/contact-state-department-revenue/L9qVToi02_US_en_US are the source of information for specific tax requirements.

Latest Version

15.1.0

July 06, 2024

Intuit Inc

Finance

Android

3,032,496

Free

com.intuit.mobile.taxcaster

Report a Problem

User Reviews

Jess

2 years ago

If I could give a zero I would. Usually turbo is right on point with the calculations, but this year they are way off. Seems they need to do another update since the last was in November 2022.

A Google user

6 years ago

I have much enjoyed this app over the past few years. It has always given a pretty close to accurate estimate.. usually with in a couple hunderd dollars either way. this year it was off by over $2000 .

Michael Czawlytko

3 years ago

Absolutely inaccurate. I entered the same info in TaxCaster that I did in TurboTax. TaxCaster told me I'd owe a lot to the IRS. Thankfully, it was wrong and the IRS owed me thousands. But if the app got it wrong one way, I'm positive it gets it wrong the other way too.

Nonna Urbizzness

4 years ago

2020 version at this date does not show correct standard deductions based on age 65 and other years. Also, shows incorrect tax due for taxable income (online version also misses this). I hope they fix these.

Michael Garcia

3 years ago

I Needed the TurboTax Refund Advance so bad but got denied!!! TurboTax you suck. I could of e-filed for free. Dont Use TurboTax. $119 for using TurboTax Live Deluxe + Refund Process Service of $39 for paying TurboTax using federal refund. Total$158 + tax. Never did you mention that if I pay TurboTax from my Refund that my cash advance would be denied. Cause TurboTax failed to mention that you cant do both. Cause you cant send cash to two banks. You cant pay TurboTax bank and your bank too.

Diane Jones

3 years ago

See Line 12b of the Form 1040 instructions. The program is including non-cash charitable contributions which are not allowed unless itemizing. I haven't worked through all of the possible scenarios, but found the error in the app while preparing my taxes. Otherwise, it's a 5 star for me.

Judy Killeen

1 year ago

I am single with no dependents, so the 2023 deduction should be 13,850, but instead, the updated 2023 version is using 20,800, which is the head of household deduction, so my refund is way overstated. This is disappointing since it has been useful in the past. Hope it gets fixed soon.

A Google user

6 years ago

I have always used this app to calculate my tax return. This year the app is way off to the refund I am going to get. Like another reviewer said by $2000. maybe need to recheck calculations and update. Please. I like using this app and recommend it to everyone because it has always been so accurate.

Bryan Trubey

1 year ago

Trash, inaccurate at best. Even more.mind blown that it doesn't connect with the their TurboTax app. It's trash too so not really surprising. Don't waste your time or moneywith this app or company. It will be better applied somewhere else.

A Google user

6 years ago

It is WILDLY inaccurate for certain incomes. Like mine, where my gross incomes make me not qualify for EIC, but since the app ONLY asks for TAXABLE income it is saying I will get quite a bit in EIC. My taxable income is far lower than my gross since I have $100 a week in insurance, 55 a week goes to HSA, and 6% to 401k. There is about 11,000 difference between the two.

Cheri Ertel

3 years ago

I have used this app for 5 years or so and it's always been spot on, even though I don't like the results, but they are what they are. Problem right now is its not showing 2022 results, it still says 2021. Hope it's updated soon.

MockingjayYT

2 years ago

Incorrect calculations, which renders this app useless. Good thing I spotted their error. I'll pass filing with TurboTax and instead do them on my own. My calculations are accurate, this app is not.

Irish Tony

3 years ago

Waaay off for taxes to be filed in 2022. Check your programing for the CTC. If left at $0, it shows no credit. When an amount is entered, it shows a negative balance. Remember, the payments made in 2021 were 6 months advance, per child, (for those that received all 6 months.) There is a 6 month bulk amount clamable, per child, on one's 2021 taxes as well. Also, there is a loss of return when adding stimulous recieved from March 2021. This is suppose to be non taxable. So, why the loss?

Abbey (Abbadabs)

2 years ago

It over estimates by A LOT giving false hope to those who are in dier need of their refund. I would've given it 5* had it been under estimated. It was over by $2,300. That is a huge miscalculation. Sure im still getting more than what i thought personally but its still $2,300 that i cant understand why it would assume so much more with a super simple single w-2. Makes no sense. It's nice to have for fun but USE CAUTION and dont get your hopes up. Updated app & now it's correct. Bizarre!!

A Google user

6 years ago

I have had the taxcaster for the past 5 years and it has always been very accurate. This year that is not the case. This years taxcaster is very inaccurate...around $2,500 off. I'm very disappointed. I try to monitor my taxes closely to make sure I am having enough deducted and such so the big discrepancy this year was a shocker.

Renee Williams

3 years ago

Very wrong! This app showed a refund of $17,000!! I knew that was ABSOLUTELY WRONG! I use TurboTax anyway so when I did my taxes last week I knew we would not be getting a refund like that. It was $12,000 off from actual refund! And yes, I entered all info correctly into TaxCaster so I'm not sure how it came up with that number.

Chasity Dill

4 years ago

Refund estimate was wayyy off. First it showed a really high number I knew couldn't be right, but hoped. Then when I went back in, it was lowered. I thought, ok. not bad! went and filed and it was still off 2k. disappointing. Normally its pretty accurate. I will Re-Rate next year at tax time. Edit for 2020 taxes. Estimate was exact. To the dollar.

A Google user

6 years ago

Edit: Since the newest update, it will give the correct refund amount, HOWEVER- you have to enter all information, it will give an amount that is roughly $2,000 less than it should be. You then close the app and reopen it, and it shows correct amount. Have used this app for a few years, and has always been accurate. This year, however, it said I would be getting back $9,192. When i actually went to file my taxes, i was told i will only be getting $6,927. That is an inaccuracy of $2,265!

A Google user

5 years ago

Very inaccurate tax calculation. I just finished my taxes and may owe a penalty. I assumed that I had just estimated something wrong. But, it turns out that I estimated a little high and the app still undercaluculated the taxes. It's good for helping you collect your normal income and deductions, but not good at the tax calculation. The web version is equally inaccurate for me.

A Google user

6 years ago

i have used this app for a few years and this is the first time ever it was wrong. I even messaged them on Facebook to tell them it was incorrect but they assured me it was up to date with the new tax reform. I guess they got enough complaints and fixed it within the last 2 weeks but it's still off. you also have to close the app and reopen it to get the correct refund amount otherwise it's the wrong amount until then. new updated number was close to my refund amount but off by 600 dollars.