SoFi - Banking & Investing

June 02, 2024More About SoFi - Banking & Investing

- SoFi mobile banking users can earn up to 4.60% APY on their checking and savings accounts.*

- Discover mobile banking with all the features of a big bank without account fees.

- Banking with SoFi gets you paid up to 2 days early when you set up direct deposits.**

- Enjoy easy banking with over 55,000 fee-free ATM locations.

- Earn unlimited 2% cash back rewards with your SoFi Credit Card^^

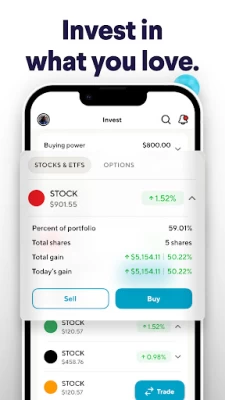

Investing with SoFi gets you more.

- Get up to $1000 of stock when you fund a SoFi Invest account.

- Invest in popular financial products like stocks, ETFs, and IPOs with zero commissions.***

Automate your investing with no SoFi management fees.

- Save and invest in your future with SoFi IRAs and other retirement products.

- SoFi’s user-friendly trading platform allows you to buy and sell options online.

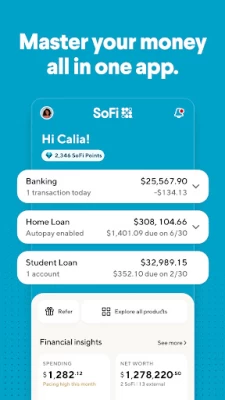

Better banking and financial health begin with SoFi.

- Experience zero account fees and no fee overdraft coverage.****

- Use our banking app to view upcoming bills to ensure you never miss a payment.

- Our mobile banking app gives users insights into their spending habits.

- Banking with SoFi enables you to monitor your credit score at no cost.

- SoFi Plus enables our direct deposit users to earn more, save more, and access more.

*SoFi members with direct deposit can earn up to 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum direct deposit amount required to qualify for the 4.60% APY for savings. Members without direct deposit will earn up to 1.20% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

**Early access to direct deposit funds is based on the timing in which we receive notice of impending payment, which is typically up to two days before the scheduled payment date.

***Investing in an Initial Public Offering (IPO) involves substantial risk, including the risk of loss. For a comprehensive discussion of these risks please refer to SoFi Securities’ IPO Risk Disclosure Statement.

****Overdraft Coverage is limited to $50 on debit card purchases only and is available to customers with monthly direct deposits of $1,000 or more. Members with a prior history of non-repayment of negative balances are ineligible for Overdraft Coverage.

^^See Rewards Details at sofi.com/card/rewards

Fixed rates from 8.99% APR to 23.43% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of and are subject to change without notice. The average of SoFi Personal Loans funded in 2022 was around $30K. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Better banking and investing starts with SoFi.

Support: Call (855) 456-SOFI (7634) or chat with us online at https://www.sofi.com/contact-us/

Website: https://www.sofi.com/

Social:

https://www.facebook.com/SoFi

https://www.linkedin.com/company/sofi/

https://twitter.com/SoFi

https://www.instagram.com/sofi/

Mobile Banking with SoFi means 2-day-early paychecks with direct deposit and automated saving features to help you plan your future.

SoFi. 234 1st Street, San Francisco, CA 94105 ©2023 Social Finance

Latest Version

2.204.1

June 02, 2024

Social Finance, Inc.

Finance

Android

3,657,358

Free

com.sofi.mobile

Report a Problem

User Reviews

Mony Mony

habtamu bededa

1 year ago

I am very very like App_ Account number 1021600171195

Dana Kennette

4 years ago

This is literally the best EVER!!! Not only can you do EVERYTHING in the app (checking with round-up going into your savings, credit card, investing, and vault accounts to save for a rainy day), but there are quick "classes" you can take, for free, on any number of topics to assist you in taking charge of your financial security. You can also attach all of your other banking or credit cards so you can see them all in 1 place. EVERYTHING IS FREE!!! There aren't any fees attached to anything.

William F Nappi

2 years ago

Pretty good site. Not set up conventionally in a way most sites are that appear more common. It will be better when they add the feature that allows you to choose notifications such as scheduled payments as presently there's no option to receive such notification. Some room for improvement but again, not bad. It could be a little more intuitive I suppose. Too often when you have to guess what to click you can find yourself wasting time going in a loop. Bottom line: I believe they'll get better.

Dmitry Shapovalov

2 years ago

I use the app for budgeting, and generally for that I find it better than competitors. The lower rating is because if you hit any issue, there is no support. I had an issue with account sync and their chat support's only solution was to delete and re-add the account, meaning recategorizing all transactions. Now I had an error trying to change the category for the transaction, and they hung up on me saying it was by design, refusing to recognize an issue and escalate it further. Not great.

Edward

1 year ago

SoFi has overall been a wonderful bank for me. However, with the Android App on my S24 Ultra, I notice it makes my phone overheat and the battery manager shows it uses so much battery in just under 10 minutes. No other app causes this and I don't have this problem on the iOS version of the app. I hope it's just a bug that gets fixed soon. Until then, web browser it is.

Alejandro Ramirez

1 year ago

Great UI. Easy to navigate. Tons of options. Love that I can keep track of my credit cards, loans, and any financial account I have on this app. Not to mention having a creat interface for the checking and savings account. Also, the app rewards you with points just by doing normal stuff such as linking accounts.

Demetri Postway

1 year ago

I like SoFi, but I recently noticed that I haven't received a single push notification from the app even though I have the notification I want turned on in the app and the app has been granted the notification permission. I have this issue on all 3 of my phones (2 Androids, 1 iPhone) so the issue is most definitely with SoFi. I really don't want to open another banking account with a competitor, but I will if I must.

D Nieboer

1 year ago

I can't track my balance no matter how hard I look. I have a $50 transfer that does not show anywhere in my balance. It shows as a transfer but not as available. Why is that? Not happy at all with app function/ convenience. May Uninstall. If you aren't making it convenient for me to track my own money than the app is futile for me. Too much clutter!

Brian Folwell

1 year ago

It's bloated with ads/ promotions. Can't customize any of the screens. They try to sell you services such as life insurance, credit cards, and personal loans. They share all personal info. They offer a high savings apy on the contingency that you link direct deposit with them. The investment section lags. Customer support is slow. It's cool to have banking and investment within the same app, but the automated investments are companies with diversity, equity, and inclusion :/

Michelle

1 year ago

There are these fairy points I have that somehow cannot be redeemed on the desktop browser and also don't show up in my app. The whole UI/UX is frustrating to navigate too. One time I had to call for a fraudulent charge on my card too and the person had made it seem like it was my fault someone tried to charge me when I didn't authorize the service. Edit: Okay, today they were very helpful and kind with my whole account. But the app still needs a lot of work!

Suzanne Dwaik

1 year ago

Was enticed by Savings High Yield. Sadly, only months after I switched all of our funds to sofi, I began to receive unwanted one-time passcodes for authentication. I thought it was very odd that I was receiving this when I did not request it. I called and they said to change my password and even my username, email, etc. However, this happened a total of three times. Very clear that they are incompetent in their cyber security practices and allowing data harvesting to occur. Pathetic. Stay away.

Kaitlin Moore

1 year ago

I like the system overall, but they're not "modern" enough. Transfers take WAY too long, as well as check deposits, and they apparently have zelle, but it's not integrated into the app efficiently. I'd recommend the app for their high yield interest, but it's better as a savings account than it is as your primary checking account.

Jacob Okochi

1 year ago

I want to love this soo bad. I have looked for a bank like this going on a decade ... It basically combines my Chime/ETrade/Credit Karma/Credit Union all in one ... And it feels like it. My hope is that they will get there, but I've said that too many times before. If they can simply and clean up the UI this thing will slap. Currently, it's anxiety producing and there is no need for it ... 99% of problems are UI ... 1% is syncing. I am still waiting for my other investment accounts to sync.

Tiffany

1 year ago

i like the improvements made to the dashboard that allows me to see more of the financial insights. wish the accounts would stay connected and that it would support my mortgage company and track property value via zillow. yes i can track anything manually, but it would really be helpful to get more accurate and current data automatically. the tip is to not solely rely on plaid to connect to financial institutions..

Ryan Karvelas

1 year ago

It is really a great start. The rewards,checking,savings etc.. The investment side needs a lot of work. You are way too limited in trading options, searches, lists, lack of in house crypto, lack of easily readable & searchable gainers from not just the top stocks but the whole game which potentially earns way higher daily trading returns. Take a look at what Robinhood does right integrate it into your investment application & you really would have a true game changing banking & investing app.

Tim Stasko

1 year ago

Sofi seemed very attractive with it's high yield offers and connections through relay. Little apprehensive at first. My dad used it, loved it and told me to give it a try. So I gave it a try. What I mentioned above was accurate, but also add in ease of use and all in one banking. Switched from a chain bank and I never want to go back! Would love to do marketing for this platform, as it would be easy to sell!

Christian Morrison

1 year ago

This bank has a great app and UI, but it works until it doesn't. And when you have issues, you are marooned. Their customer service is abysmal and is utterly unequipped to deal with anything beyond surface level app troubleshooting issues. This is unacceptable for a service that deals with people's money and that is why after giving them an earnest try, I will be looking switching banks once again. Extremely disappointed.

Jacob Kral

1 year ago

Like the banking and spending tracking, etc a lot, great system. A little cluttered UI but it's not too bad. Main issue atm is I always have to open the app twice, the first time it will act like it's open, but there's no UI, it's just still on my home launcher. Sometimes the fingerprint button is there but nothing else. Then I force close it and open again, and the ui will load normally and work fine.

Meghan Arias

1 year ago

The app works well, however, the home and banking screens are quite cluttered with different offers and promotions. While informative, they make the app unnecessarily overwhelming when I need to get in and out quick just to check my balance. I would love to see a "minimalist mode" option in settings and/or the option to make the main screen when opening the app automatically the banking tab or other tab of choice. I think integrating those would make SoFi much more modern and user friendly.

Moe Felix

1 year ago

HATE the new update! It's harder to navigate and find everything now. Also, I have multiple vaults and had them in a specific order (for a reason) and the new update now has them all mixed up with no way to rearrange them back. I've been with SoFi for about a year now and, overall, have enjoyed the perks and functionalities of it. However, the Zelle incapability is a HUGE problem! Most people refuse to accept payment by SoFi's ridiculous options of joining up or waiting 2-3 business days.

Adam SmokesAndBarrels

1 year ago

Overall the app does what it needs to. Been with SoFi since the very beginning, but lately it's getting more pushy for advertising. As someone who's finally debt free, the last thing I want are pushy offers to get back into it. App has other irritations, like back button going to a different tab, not just back to the previous screen. Saving an Autopilot change collapses the menu every time, etc. Edit: Vaults no longer alphabetical on Android. Fix this!!!