Self Is For Building Credit

June 04, 2024More About Self Is For Building Credit

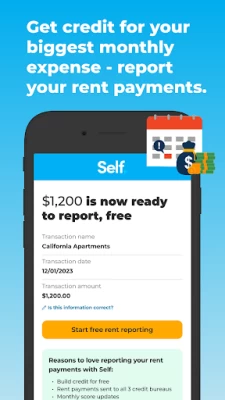

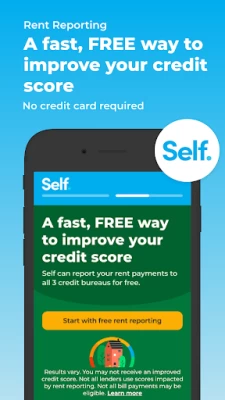

BUILD CREDIT BY REPORTING YOUR RENT PAYMENTS FOR FREE

- Increase your credit score for free*

- Build credit with all 3 credit bureaus — Equifax, Experian, and TransUnion

- No hard pull, no credit check

- No credit card required

- Establish positive payment history — credit’s #1 factor†

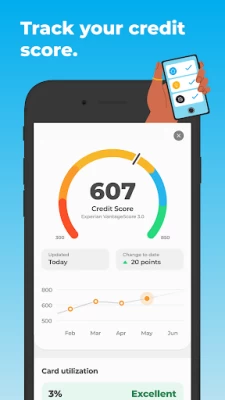

- Track credit score with VantageScore 3.0‡

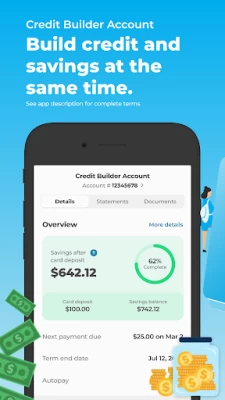

GROW YOUR CREDIT & SAVINGS WITH THE CREDIT BUILDER ACCOUNT§

- Plans start at $25/mo.‖

- Unlock your savings at the end, minus interest and fees¶

- No credit score required

- No hard credit inquiry, no credit check

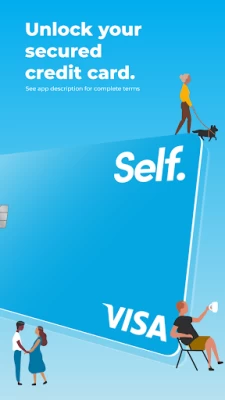

UNLOCK THE CREDIT CARD FOR CREDIT BUILDERS

- Work toward a secured Self Visa® Credit Card¹ with a Credit Builder Account§

- No credit check required

- Control your credit limit

- Build credit with all 3 credit bureaus

- Use everywhere Visa is accepted in the US

REPORT MORE PAYMENTS FOR MORE CREDIT

- Build credit with cell phone, water, electricity, and gas payments for $6.95/mo.

- Add up to 5 payments to your TransUnion credit report each month

- Credit monitoring by TransUnion

- Identity theft insurance up to $1 million

- Cancel any time

TAKE YOUR CREDIT SCORE TO A NEW LEVEL

People with Self Credit Builder Accounts who start with a credit score under 600 and make on-time payments lift their credit scores by 49 points, on average.²

ACCESS THE SELF VISA® CREDIT CARD

Card eligibility requirements include a Credit Builder Account§ in good standing, 3 on-time payments, $100 or more in savings progress, and satisfying income requirements. Requirements are subject to change.

* Results vary. You may not receive an improved credit score. Not all lenders use scores impacted by rent reporting. Not all bill payments may be eligible. See learn.self.inc/lpg/mpa/rent-bills-landing for details.

† See https://www.ficoscore.com/education#WhatYour FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

‡ Credit scores will only be available to customers our 3rd party vendor is able to validate.

§ Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

‖ Minimum and maximum repayment period for all loan products is 24 months. Maximum Annual Percentage Rate (APR) of all loan products is 15.97%. Sample products are $25 monthly loan payment at a $520 loan amount with a $9 administration fee, 24 month term and 15.92% APR, Total Payments of $600; Check the pricing page in the Self mobile app or Self.inc for current pricing.

¶ Minus fees & interest. Individual results may vary and are not guaranteed. Improvement in your credit score is dependent on your specific situation & financial behavior. Failure to make monthly minimum payments by the due date each month may result in delinquent reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

¹ The Self Visa® Credit Card is issued by Lead Bank, First Century Bank, N.A., or SouthState Bank, N.A., each Member FDIC. See Self.inc for details.

² Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, starting VantageScore 3.0 under 600, who made on-time payments. Other factors, including activity with other creditors, may impact results. On-time payments does not mean full program completion and past performance based on study does not guarantee future results. Credit score increase not guaranteed.

Self Financial, Inc. 901 E 6th Street Suite 400, Austin, TX 78702

Latest Version

5.4.1

June 04, 2024

Self Financial, Inc.

Finance

Android

3,521,231

Free

com.selflender.thor

Report a Problem

User Reviews

Starr Haynes

4 years ago

So, got the app to improve my credit score. And at first it was working perfectly, but once they sent my check, cause I was not ready to get a credit card at the moment, so I wanted the cash I saved up. But once they sent my check , the closed the account and my credit score dropped 65pts. I called but noone answered. Like what was the point if my credit score never fully improved.

Ron Genius

4 years ago

My bad credit definitely improved dramatically with Self, you should use it too. My only complaint is the $25 fee you must pay upfront to get your Self Visa Credit Card. They advertise it as if you get it for nothing by unlocking it through paying enough payments on time, which I did, but sadly, you do not get it for nothing, you get it for $25 once it's unlocked. I won't pay the $25 to get my unolcked Self Visa Credit Card. If they waive the upfront first $25 fee (it is annual), I'll get it.

Lisa Miller

2 years ago

Love Self!! Helps you to save money and improve your credit score at the same time. Also you can access a credit card after a certain period of time. I love Self!! It is still disappointing at Payout time. Every time I've had to fight to get my money and that is just wrong. It's our money to begin with. They tell you they will "Direct Deposit" it to your Bank Account on a certain Date but we are still supposed to wait for it to show up?!! It shouldn't be this difficult.

Koraline Hampton

2 years ago

My credit score has went amazingly using this app along side a secured credit card. My friend mentioned this one to me and I've got my fiance and several friends to use it. There are several payment options to chose from and their not high at all. The lowest is $35 a month I believe, so please, if you have bad credit, or credit that just needs a little boost, use this amazing app. You can also add your phone, rent, or monthly house payments into it to help you score; if it's not paid cash.

Jenny Shrum

4 years ago

ABSOLUTELY AMAZING!! I've not had one bad experience with this app. I thought it would cost me more in fees, than what it was worth. I was wrong!! I have never established a base credit and couldn't get an opportunity because I had no credit for a lender to look at. I was at 409. I now have 3 credit cards, a loan and am on my way to getting a mortgage!! I would say that raising my non-existent score 230 points, in 8months is impeccable! 100% definitely recommend and i have to everyone i know!

David K.

3 years ago

Beyond helpful, absolutely amazing!--- update 9-9-22-- used the self credit card option. It takes the money you pay into the account and uses it like a secured card. Seems pretty good, the original account had worked well. Problem is, if you mess up on finances, (which is 100% on me), they aren't so helpful. They obliterate your credit report, even though the money on that card was yours to begin with. They tack on fees in excess of 150 on a 300$ limit card. Not as advertised to say the least.

A Google user

5 years ago

The POSITIVE: It's a great place to start for showing you're making steady ON TIME credit payments on a loan, but that's about it. The DOWNSIDE: it increases your debt-to-ratio and lowers what lenders will offer you on another extension of credit (like a mortgate, car loan, credit cards, etc. ) until it's paid off. Helps to diversify your credit mix; lenders like that.

Cory

2 years ago

Original: So far so good. I've only been making payments for a few months now but it has helped my score as far as I can tell. You're essentially buying points towards your credit score. ***Edit: everything went smoothly, made payments every month (always before they were due just to be safe) and cashed out at the end of the term once it was paid off but now my credit report shows two missed payments AFTER the loan ended. I disputed with them and TU didn't fix it. Would not recommend

Luuna Quinn

1 year ago

I'm not a financial expert, but their credit builder program is easy to use and great for saving money and building credit simultaneously. If you can make enough money each month for a year to afford setting aside money, I highly recommend it. I made every "payment" on time so I don't know what happens if you miss a payment, but it boosted my credit score over 100 points, and all the payments I made get sent back to me in one lump sum after the year ends. I think it is some form of CD account?

Shane Myers

1 year ago

Don't download, it let's you create an email, then keeps restarting. I've tried resetting passwords/pages. I've checked 3rd party ad blockers and cleared all settings. Listen to the reviews!!! Now I have an account I can't access that's connected to my email. I'll try it on the computer, but even if it does work, I still can't use my phone.... LAMEEE

Jesse Dye

1 year ago

Not a fan. They nickel and dime you the whole time. they charge you $3.50 to make a payment other than ACH BANK transfers, which typically takes 2-5 days. They seems to take 6. They bother you with a nag screen every time you open the app to set up auto payment. But if auto payment doesn't go through they charge you $15 even though the account isn't passed due. I set up a payment on the 23rd of the month, the money came out of my checking on the 24th, but wasn't applied until the 30th.

Mary Sherman

1 year ago

Dropped my credit score 27 points. Rent and bills feature doesn't work. Secured card offered after 3 on time payments and $100 in savings still not available despite being on monthly payment five with all other criteria met. Do not use this app if you want to improve your credit. It has done the exact opposite. And yes I contacted their support and no they didn't fix either issue with the secured card or with the bills feature.

The Dusty Shredder

1 year ago

For someone with no credit history at all, this is an excellent option. My only gripes are these: I can no longer select my new credit limit because the button to accept is below the bottom of the page and the page WILL NOT SCROLL to allow me to press it. Second, I can no longer sign in with biometrics. Simply fails to work. IMO, this app is a failure for a company with so much money to pay people to make it actually functional.

Jacinta M.

1 year ago

I made my very first payment & It shows on my account. Transaction was successful And in the savings it shows I Have $26. Next day I opened the app. And there's nothing shows all zeros payments failed. If that's the case then where is my money didn't transfer back to my account Because if it did fail, the money would be showing in my bank account, but it's not. And this was my very first payment. I Definitely would not recommend self My opinion, kickoff is way better.

wyatt vliek

1 year ago

A massive boost by itself, and then went on to become the literal foundational building block, of my steadily growing credit health!! I couldn't possibly say enough great things about it. Get it. Follow the directions. Make minute financial contributions, (ie, interest, past due accounts, etc)... Reap the benefits, with a large initial boost in your credit score, and then pick up the reins yourself.. You won't regret it!

Christopher Hudspeth

1 year ago

I paid over 800 dollars in two years. Was expecting to use this as a savings program. They are telling me I'm getting 39 dollars back...It very clearly states on the page at the amount I agreed to pay monthly that I will get back 717 dollars at the end of the term, also very suspiciously it seems it is impossible to screen shot that page. I will be using an actual camera to take a shot of that page. I did sign up for the credit card, however I never received it, never used it, and canceled it.

Tim Mitchell (Syndratic01)

1 year ago

I like the app, it's helped me build my credit in a easy way, I just think that it shouldn't be so hard to cancel a credit card. It would be nice to have an option to replace it or deactivate the card without going through customer service people who aren't very courteous or helpful. what about those times where it's too late to do anything about a stolen card and you could've stopped a credit theft with a swipe but instead you have to deal with automated bots and unhappy customer service people

Ingrid Fortmeyer

1 year ago

This is one of the best ideas out there for taking personal responsibility for your finances coupled with the worst interface technology and access to actual follow through. I find being able to USE the website and app to check, update, make payments, etc frustrating at best and impossible at worst. 20 minutes reentering the same information, continuing, and looping back to the original entry page. Help features are AI bots, an when you want live support it always says none available.

Jeanette Moran

1 year ago

It worked fine until the last update, now not only do I have to sign in on line, but it takes 4-5 times to get into my account. I have to sign in multiple times (each time getting bounced back to the sign in screen on the app) before I can get into my account. 4/1/24: update: the most recent update is even worse! Every time I try to sign in, it not only kicks me out of the app, but it shuts the app down! The app crashes every time I try to sign in!

La'Kendra McQuay

1 year ago

Well in addition to the making a payment solution...I contacted you all yesterday on Friday during normal business hours, and my issue still was not resolved. I'm still experiencing the exact same issue. It's sad that you all are great with assisting in helping to fix credit, but your app, and online services suck big time. It's a huge inconvenience that we can not pay over the phone using your automatic system, or that you all can't take a payment over the phone with an agent 😒