PocketGuard・Budget Tracker App

July 27, 2024More About PocketGuard・Budget Tracker App

Monitor Your Financial Status with Ease

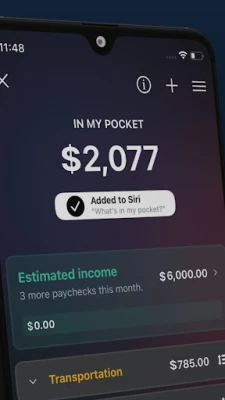

PocketGuard helps you balance your income and expenses effortlessly. The "IN MY POCKET" feature calculates your disposable income after accounting for bills, savings goals, and essential expenses. This ensures you always know your safe-to-spend amount, integrating seamlessly into your monthly budget and helping you avoid overspending. Keeping track of your money and managing your budget has never been easier.

Gain Insights with Comprehensive Financial Analytics

Understanding your financial habits is crucial for effective money management. PocketGuard provides detailed analytics and reports that reveal your spending patterns, allowing you to make informed adjustments and optimize your budget. These insights help you see exactly where your money goes and how to manage it better, ensuring you stay on top of your budget planning.

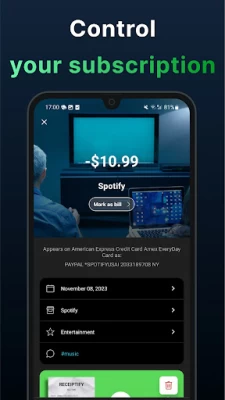

Stay Organized with Bill Tracker and Subscription Manager

Link your bank accounts to PocketGuard and transform it into a powerful bill organizer. The app automatically tracks your bills and subscriptions, integrating them into your budget to ensure timely payments. This helps you avoid late fees and keeps your financial obligations organized and manageable. Managing your money and staying on top of your bills is now simpler than ever with an organized budget.

Achieve Your Financial Goals

Setting and reaching financial goals is essential for successful money management. PocketGuard equips you with the tools to establish and monitor your goals, whether it's reducing discretionary spending or saving for a specific purpose. Track your progress and stay motivated to achieve your financial aspirations. Effective budgeting and money management are key to reaching your financial targets.

Experience Bank-Level Security

Security is a top priority with PocketGuard. The app employs 256-bit SSL encryption, the same standard used by major banks, along with additional security measures like PIN codes and biometric features (Touch ID and Face ID) to protect your financial data. Rest assured, your money and personal information are protected as you manage your budget.

Upgrade to PocketGuard Plus for Enhanced Features

For advanced financial management, consider PocketGuard Plus:

Monthly subscription: $12.99

Annual subscription: $74.99

Subscriptions are billed to your iTunes account and auto-renew unless canceled 24 hours before the end of the current period. Manage your subscriptions in your iTunes Store settings. Keep your budget and money management tools up-to-date with these enhanced features.

Privacy and Terms

Your privacy and security are our top priorities. For detailed information, please review our Privacy Policy and Terms of Use:

Discover our Privacy Policy here: https://pocketguard.com/privacy/

For Terms of Use, visit: https://pocketguard.com/terms/

Discover Financial Freedom with PocketGuard - Budget & Bills Tracker App

Managing your money and bills efficiently is the key to financial freedom. Rest assured, your money and personal information are protected, giving you peace of mind as you manage your budget and track your bills. With PocketGuard, financial freedom is just a step away. Using PocketGuard's budget features will help you stay on top of your finances, ensuring a smooth financial journey.

Latest Version

5.6

July 27, 2024

PocketGuard, Inc.

Finance

Android

214,715

Free

com.pocketguard.android.app

Report a Problem

User Reviews

A Google user

6 years ago

PocketGuard has been great for my budgeting and spend tracking. The app offers way more than that, like if you're bigger on setting goals or reminders for paying bills they have that ability. It's very non intrusive with any forms of advertisement or 3rd party suggestions. You have to specifically look or push for suggestions in how to save or change trends in your spending before pocketguard brings up any sort of offer or advert. Small detail but I love the UI and visuals. Very modern and sleek

Steve Danner

2 years ago

So far so good! Made the switch from mint and Pocket guard has proven an excellent replacement. Well worth paying a little money! For those coming from mint, you'll of course, need to spend a little time putting your categories back in order and learning a new interface, but once you do, you'll find it does all the budgeting management mint did, and often does it better!

Justin Malmstedt

2 years ago

This is the best budget app I have used. Like most people my financial view is based on what I can spend right now after goals, paying bills, keeping certain budgets strict, while having leniency in others. The overview shows next paycheck and bills due before that paycheck. Breaks down how much "extra" money you have left per day. You can do folder or zero based budgeting with more customization than YNAB. The automated recognition of bill and payment schedules is better than any other. Cheap!

Mari Lee

4 years ago

Decent. Needs work. A LOT of work. The refresh rate is ABYSMAL. It claims to refresh saying last refreshed at xx:xx but doesn't reflect incomes or purchases for days. It's horrible at finding similar recurring payments. I have 3 student loan payments and it automatically found 1 and teaching it the other two was difficult. It also didnt pick up my direct deposits across ANY of my accounts. I love some of the features. I'm gonna keep an eye on it and update on the future.

GlassHalfPhil

4 years ago

This is the first budgeting app to successfully connect with my credit union app. So glad I can start automating my budgets. Also love the "do not include in calculations" button for each transaction. We use a credit card for all our purchases (points, baby!) and counting every purchase and every credit card payment would make it look like we're spending 2x as much as we are.

A Google user

5 years ago

The ideas behind the app are sound and the simplicity is really nice, but upgrading adds little to no additional features. It took several months to not require manually reconnecting banking information, there was a bug that caused some duplication of transactions (that has yet to be cleaned up) and generally a lack of some basic features make this app little better than a spreadsheet. The main reason I am deleting is due to the horriblely non responsive customer service.

A Google user

6 years ago

the main reason I cancelled were the incessant syncing issues. maybe if I didn't have like 12 accounts that wouldn't be a deal breaker but i just wasn't getting anything out of the app. it did motivate me at first, it was easy to use - just tedious. it seemed secure, but unless I am getting a lot out of the app it's hard to justify repeatedly sharing such important personal finance info.

Colin Kwiecinski

2 years ago

This app perfectly serves my goal of tracking transactions across all my accounts. I wish it was less buggy though. some issues I encounter are modifications to transactions not being persistent, having to sometimes specify what category my income is, despite it being the same recurring deposit, and I wish I had the option to bulk edit (change category) multiple transactions at once. Overall very happy though, I'd recommend it.

Justin Divelbiss

2 years ago

I like the app for the most part. It's great for keeping track of all my accounts and I like that I don't have to manually enter in transactions. Love the app layout as well. But when you edit or split a "pending" transaction, once that transaction is officially posted it gets rid of the edit or split and you have edit and split it again. There is a feature that makes this easy to do though. Also has issues syncing accounts sometimes but the support team is usually on top of that when contacted.

A Google user

6 years ago

I've been looking for a good cash flow budget app for years! Most budget apps don't account for fixed bills, savings, and debt reduction goals. Instead, they say you have a ton of money "left in budget" when actually your landlord hasn't deposited your rent check. This calculates that and lets you know how much you ACTUALLY have available for groceries, entertainment, etc. It's a little spammy with suggested partners, but other than that a solid tool.

cosmic kitty

1 year ago

Continuous syncing issues with my bank have been happening. I haven't been able to pull in any bank transactions for nearly 3 months. I've reached out to support via email. But all I get back is that their engineers are working on it. I recently asked for an update and told them my frustrations and my email was flagged as spam and blocked. Otherwise, it was everything I was looking for in a budgeting app. Cancelled sub and looking elsewhere.

A.J. F.

1 year ago

The free version isn't particularly useful, but the paid version is probably the best Mint replacement I've found. There are just a few small functionality features that I really miss: 1. The ability to filter and sum categories by year, not just month, is very helpful for things like dojng taxes 2. Since companies seem to constantly change how their name shows up in the app, having the option to auto fill existing merchant names when editing them would be helpful for consistency

Alejandro Rodriguez

1 year ago

I received an email that I could use the app for free w/o a trial. I assumed it was for basic services, and for other features such as budgeting, debt reduction, and others I would have to pay. However, once I logged in, it only allowed me to sync 2 accts. If I want to link more I will need to pay. Therefore, I still consider this to be a trial. Thanks but I'll stay with my current services. Not perfect but does the basic services that I need, to see many of my accts in one place.

Rachel

1 year ago

This app is almost a perfect replacement for Mint! The only issue they have is syncing issues with certain banks. I'm waiting for them to fix PayPal/Synchrony, since I primarily use my PayPal Mastercard. Once that is fixed, I'll be able to reliably use this app instead of mint for tracking monthly spending and budgeting! Would also like a widget similar to Mint: showing total cash vs current credit card debt. Or showing current in vs out monthly net income. Current widget isn't helpful.

Ekaterina Potapova

1 year ago

I am having continuous syncing issues. One of my banks constantly disconnects, and it's a hit or miss if it connects again. Says it's good to go, but nothing is fixed. Another bank haven't been able to sync for abot a month with no updates or fixing of the issues. It's extremely frustrating. Update: still continuous syncing issues with various accounts. I got a new credit card, and I couldn't update the new credit card, even though when setting up I checked the box to automatically update.

Jarrod Moore

1 year ago

Same experience as other recent reviewers. This app doesn't seem to stay connected to Synchrony and I couldn't connect my PayPal. If those things can be fixed, I'm ready to be a paying customer. One thing that my spreadsheet does that I'd LOVE to see an app tackle is a buy now pay later repayment schedule. I don't need help budgeting. I just want a more automated way to categorize expenses, track savings, and manage BNPL payment schedule. Even better if it will forecast out a 12 month cash flow!

Mary Sloan

1 year ago

I went for the full version for a month and tried getting everything set up, took hours. It presents a few options to connect accounts but yet I still couldn't get all in. Then came the constant disconnect issue. I get the mfa that requires a refresh but it keeps saying my password is incorrect and I have not changed any. My validation codes come back wrong too. I give up. Not worth 12$ a month to be fighting to reconnect weekly and it consumes my time just to review my expenses. Too much work.

Matt D

1 year ago

Good concept, poor execution I signed up for the yearly subscription...bad idea. Right afterwards I noticed some major features just were not working. The subscription monitoring feature, which is the main reason I signed up for premium, shows random subscriptions that I don't have, and is missing a lot of the subscriptions I do have. The app also seems to mark account transfers as an expense, even though I've linked both accounts to the app.

Grace J

1 year ago

Migrated from mint. Worst experience! Accounts stop syncing. And when my credit card account number changed. It decided to make my account inactive and wipe off my transactions. Now all my budgeting customization is gone and none of my historic budgets are correct. Also, when I suggested for few upgrades and changes, their response was always the same. Unfortunately, we don't have staffing to do it. We don't plan on making improvements, etc. I got lifetime membership and I feel I wasted money.

Katelyn Hooppaw

1 year ago

I've been using it for a year now, and overall, it's great! It can take a couple of days for transactions to show up in the app, but it's still helpful. I use the paid version and I like being able to see all my transactions and accounts in one place and create custom budgets. The only reason I've considered trying other apps is to get more smart features like AI to let me know how I'm doing budget-wise more often. However, no other app lets me see my credit cards and bank account together.