NerdWallet: Manage Your Money

June 16, 2024More About NerdWallet: Manage Your Money

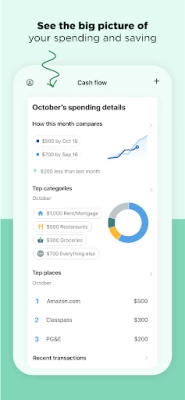

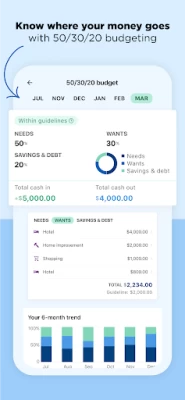

KNOW YOUR CASH FLOW

- Track spending across multiple cards

- Keep track of your budget with our 50/30/20 breakdown

- Get detailed spending insights

- Track your bills, expenses and more

- Discover ways to cut back or save

- Compare spending month-to-month

- See your top spending categories for easier budgeting

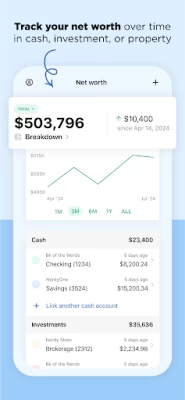

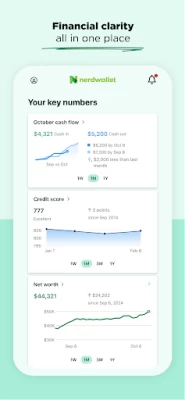

KEEP UP WITH YOUR NET WORTH

- See how your income, debts, investments, and home value all add up

- Follow the history of your net worth

- Zoom into the details of your net worth and track individual accounts over time

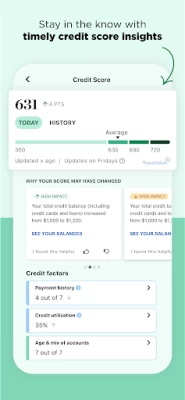

MONITOR & BUILD YOUR CREDIT

- Access your credit score and credit report any time

- Get score change notifications

- Understand the factors that affect your score

- Learn ways to keep building – whether it’s increasing your credit utilization or paying your bills earlier, and more

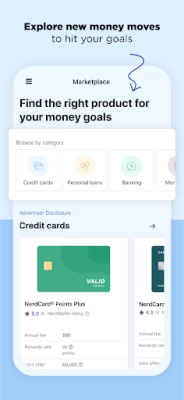

SMART MOVES FOR YOUR MONEY

- Quickly find and compare more rewarding credit cards, better loan rates, and higher-earning bank accounts

- Join NerdWallet+ so you can earn rewards worth up to $350 for making smart financial decisions - like paying your credit card on time

- Join Drive Like A Nerd so you can score your driving in real-time and get better auto insurance rates

---

Personal Loans Interest Rates and Fees: You can view personal loan offers on NerdWallet's loans marketplace. These are from third party advertisers from which NerdWallet may receive compensation. NerdWallet displays personal loans with rates that range from 4.60% to 35.99% APR with terms from 1 to 7 years. Rates are controlled by third party advertisers and are subject to change without notice. Depending on the lender, other fees may apply (such as origination fees or late payment fees). You can view any particular offer's terms and conditions for more information within the marketplace. All loan offers on NerdWallet require application and approval by the lender. You may not qualify for a personal loan at all or may not qualify for the lowest rate or highest offer displayed.

Representative Repayment Example: A borrower receives a personal loan of $10,000 with a term of 36 months and and APR of 17.59% (which includes a 13.94% yearly interest rate and a 5% one-time origination fee). They would receive $9,500 in their account and would have a required monthly payment of $341.48. Over the lifetime of their loan, their payments would total $12,293.46.

Latest Version

11.25.0

June 16, 2024

NerdWallet

Finance

Android

1,805,263

Free

com.mobilecreditcards

Report a Problem

User Reviews

Yes

woredaw tigabu

1 year ago

Yos

Yes

Ayenew Atinafu Bitew

1 year ago

Yes

nice

Senait tagesse

1 year ago

Yes

nice

Senait tagesse

1 year ago

Yes

Merga

Daniel

1 year ago

G

1000487988921

Desa kenate

1 year ago

ETB

jtamasgeen@gmail.com

Jiregna Temesgen

1 year ago

Best help

Rate N'Review

1 year ago

BEWARE!! Once you start to REALLY try to use their service (if they really have one) the credit score is much higher than what it truly is, they take you to credit card offers which either have a 404 Error message or you're stuck clicking 'Learn More' in an endless loop because they don't have an 'Apply' button, when you check out loans the process is extremely shady- they want your bank account information to 'deposit' the funds without your acceptance of the loan or the amount. DO NOT DOWNLOAD

Lin Daniel

1 year ago

Missing too many things Missing category customization. Too many of my transactions ended up under "Services" or "Other". Tracking spending choices mostly useless. Missing transactions. Solution is to relink. Solution failed. Ok. These things happen. Contact Customer Service. Missing "software problem". All choices in dropdown menu were money and finance choices. Chose one that might fit. Got another dropdown list that again had money related choices only. Bah. Done with this.

Kristofer Flowers

1 year ago

Was really good for years. Even used it to help me get the right credit card for me. But now it's just been a pain. Doesn't connect to accounts correctly, and sometimes just drops them completely. This is my second time un/reinstalling the app just to see my accounts. It won't relink to my companies payroll card, so it's not getting half of my pay/purchases. And it says it updates my accounts regularly, but it's ALWAYS missing purchases. Mainly my utilities and bills. Credit score works though.

Justine Johnson

1 year ago

I really used to like this app, and it was very helpful for some time, but now, not so much. I can't get my accounts connected. Fidelity - unsupported. Lending club - credentials are correct, but we can't log you in. American Express - you're locked out of a part of a site that no longer exists. Go unlock your account on the non-existent page. The stuff it does actually track is great. But too many accounts can't be loaded correctly, making inaccurate at best and useless at worst.

Rod Sissel

1 year ago

Wow. Where to begin? The sign up process repeated 5 times before working. The credit score took 4 times but never worked (despite inputting the same details as my bank has). Connecting to my bank worked flawlessly. When I reopened the app, it was back to trying to access my credit score, which again failed twice. When I saw the request to re-enter my bank details, that was enough. This is the single most frustrating app I've tried in a very long time.

Victor P

1 year ago

My main gripes with the app are that it doesn't support lifestyles outside of the norm, so things like paying a few months rent in advance are incompatible with the 50/30/20 method (can't really blame the app for it though). Money transfers aren't categorized automatically so it requires a lot of manual edits. More problematic is that refunds are not tracked correctly when calculating spending. So if you spend $1,000 on Amazon and get $500 of it refunded, it'll be counted as a total of $1,500.

Matt Huff

1 year ago

Positive: this app was the first warning that my credit card has been stolen, good job. Negative: Frequent log offs, routinely shows no accounts linked even after the usual tricks (force stop, clear cache). Does not link to some of my accounts (may be an issue with Plaid, the underlying linking service). No ability to automatically track a car value. VERY minimal categorizing and budget functionality. Came here looking for a Mint replacement, I think I'll keep looking.

Russ Gitter

1 year ago

I can't say this app is for me. There's small things like my Fidelity account not being able to connect to bigger issues like nothing showing for accounts under the Net Worth tab. I can see my transactions under Cash Flow but I can't get access to my separate accounts. Also my Visa card worked at first for about a month, then I waited a month and it never updated. Which was odd since my transactions were still showing up. I finally relinked it and now it doesn't show the account at all.

Dylan Durr

1 year ago

I once liked this app. Let me know when bills were needed to be paid, decent information on credit score, my net worth, but after awhile, just went downhill. Started off with the stuff I buy didn't line up with the categories. I messaged the tech support with no help. Now my credit union keeps unlinking..now it keeps logging me out of the app and says my password is wrong. I'm done. I gave it the best chance I could.

Grant Haataja

1 year ago

I really enjoy this app for tracking net worth but lately every time I login it shows no accounts linked. If I go into settings I can see that they're still linked and it still gives me the total, but I can't see the breakdown of what's what on the net worth page, which is really frustrating. 02/07/24 edit: New problem, although this isn't NerdWallet's fault. Fidelity changed their policies to not allow any authentication though Plaid, so it's no longer possible to see those balances. :(

Patrick Templeton

1 year ago

This app has a lot of potential to replace Mint, but it has some issues to sort out. Some, but not all, of those issues include that there's no way to update an account — you just have to wait until it decides to do it. The numbers for cash flow on the web version and on the app are always confusingly different. The bill feature just doesn't work. And certain buttons in the app just don't work sometimes.

Ilia Pèrez

1 year ago

It's a pretty good budgeting app for the 50/30/20 method. I wish that it could account for splitting transactions. For example sometimes I buy more than groceries at department stores and would like to spilt the total charged to my account to the corresponding subcategories ( example I spend $234 dollars in one visit to a department store where $200 was groceries & $34 was spent on clothing).

Daniel Palmer

1 year ago

This is just a worse version of mint. I can't sync my chase mortgage and chase credit card - it's only one or the other. I don't need my credit score, but it's everywhere in the app so they can sell you stuff. All I really want is a hub for my transactions but they hide that in sub menus so they can summarize everything.

sophia johnson

1 year ago

Love the app, very user friendly and I use it everyday. The information sometimes isn't populating in Net Worth and, now that upcoming bills is only available on the app, I can't see next month total bills amount anymore. I also wish there were more connections. For example, American Express changed their personal savings and I can no longer connect.

Jeff Baker

1 year ago

Lots of broken features (filtering when clicking through their pre-built graphs just flat out doesn't work) and limited options for reporting. Cluttered and unintuitive UI that seems to have been built by someone with ADHD. Misleading information around credit scores (When is it a bad thing to pay your credit card on time?). But since Mint shut down, I guess it's better than nothing?

Kevin Northrop

1 year ago

NerdWallet is a great resource for all things financial. Not only does it offer highly informational articles, which makes it worth having alone, but you can very-securely link accounts to it to monitor your finances, spending, and even your credit report! If you care about your finances at all, you should definitely get this app!!! My only complaint is a lack of dark-mode display (as of 5/2024) -- that would be a game changer from an aesthetic viewpoint! Highly recommended!!!

Sean Tressler

1 year ago

Total garbage app. Only second day using. All recent transactions gone from checking (showing months old instead). All but one transaction gone from first credit card. All transactions gone from second credit card. All of these were present yesterday after initial set up. Help suggests relinking. I JUST SET THESE UP YESTERDAY!!! How often am I going to have to do that? How about removing instead and finding a better app.

Ciralee

1 year ago

I downloaded the app due to the positive reviews. However, I encountered several issues. The app kept indicating that the last four digits of my social security number were incorrect, which was not the case. I then attempted to link my bank account, following the same steps I have successfully used with Plaid in the past. I received an error message stating that my bank account could not be linked. I received an email/text stating they were. Deleted account will try elsewhere.

Bernadette Eve

1 year ago

Something seems way off about the app recently. I've been using it for a few years and it's always been really dependable! Now it's saying my credit score went up 5 points too 700, when it's averaged around 765 after panicking and checking my other financial apps. Feels like it's trying to manipulate me to pulling my credit score by showing me inaccurate info about the quality of my credit factors such as saying my payment history is poor when for years it's been at 100%. So bazaar for this app!

Vee Glessner

1 year ago

UI is fine, but the data is so half baked it's not remotely helpful. Very poor detection of internal transactions (account to account), not compatible with Fidelity, appears to show fake data as an "example" if it doesn't have your real data. Cue me panicking that my credit score had dropped 100 points! Doesn't keep accounts up to date, overall useless and not in any way a substitute for Mint.