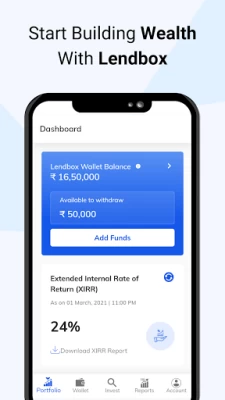

Lendbox | Investment App

September 20, 2024More About Lendbox | Investment App

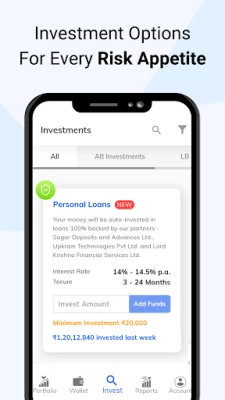

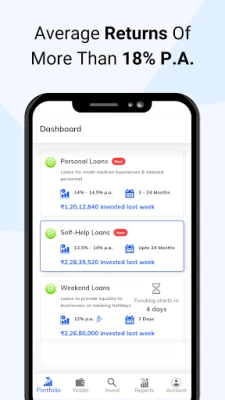

Why invest with Lendbox?

✦ Average returns of 24.5%

✦ Paperless KYC & Verification

✦ Trusted by more than 28,000 investors

✦ Rigorous borrower screening with physical verification

✦ Wealth management services

✦ End-to-end recovery and legal support

✦ Monthly payment through EMIs

✦ No hidden charges or fees

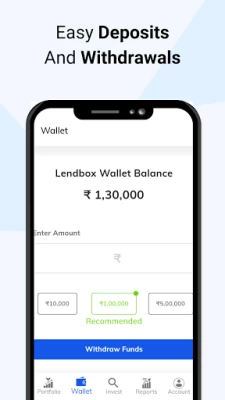

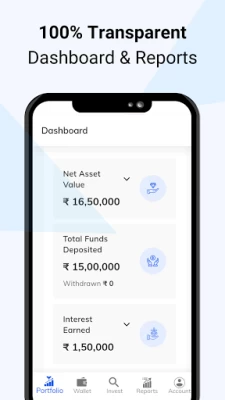

✦ 100% Transparent & easy to use

Loan details:

Loan Amount Range: 5,000 - 15,000

Minimum loan tenure: 91 days

Maximum loan tenure:720 Days

Maximum Annual Percentage Rate (APR): 26%

Example loan calculation

Loan amount: ₹ 10,000 at interest rate of 25% APR (annual percentage rate).

Loan Duration: 3 Months

Total Interest = ₹ 934

Processing fees (PF) + GST = ₹ 500 + Rs 180 = ₹ 680

Total repayable Amount: ₹ 16614

Monthly EMI Repayable: ₹ 10,000

The deductibles (interest + PF + GST) are deducted upfront during the loan disbursal.

To know more, visit https://www.lendbox.in or call us at +91-7291029298

Latest Version

1.1.1

September 20, 2024

Lendbox

Finance

Android

135,365

Free

in.lendbox.app

Report a Problem

User Reviews

Prerak Arya

5 years ago

App is good.But not for lenders. They are unable to recover the loan amount(EMI). So dont trap your self for little more interest. Be safe with your hard earned money. They always TRY to recover your EMI but that never happens. Actually they give unsecured loan so borrowers can easily vanish or deny or procrastinate.

arun kumar

4 years ago

1. Bad service 2. App is not so user friendly and lags all the time 3. Irresponsible management once you invest your money I don't understand why they are still accepting investments when they are unable to pay it back, by saying all silly reasons. 100% not recommended, please think twice before you invest your money here.

Manjeet Singh Yadav

3 years ago

There customer support is practically non existent and your relationship manager will never call you even after placing several requests for callback. Never go for micro loans And be ready to loose your principal investment also. Overall stay away from it. Note to the team : remove high returns along the name of this app (I know you earn by registration fee by luring people with high returns) . Its not possible to earn higher returns with the kind of NPAs on your platform.

VINAY BAJA

4 years ago

There is loan showing on my credit report with name transacttree technologies.when I contacted lend box when to share the details they have given me the loan and also I asked to show transaction reference that they have transferred to my account. But I never received these as a response from you guys.

A Google user

5 years ago

Hello team, I have already provided registration fees and all documents. Stilll it is taking too much time to approve my loan. And fron yesterday's app got crashed. I could not able to open app. Can you please provide solution? By when i will get the loan n by when app get work normally? Regards, Prince

A Google user

6 years ago

Waste app, they take money for registering with them, they ask for 500 rs just to apply for a loan, and when I made the payment of 500 rs its not even getting updated in their system. Its is still asking me for 500 more. When I tried to call them, nobody answered, i put call back request, no call back, they done even reply to emails. Its fraud app, i will not recommended it to anyone. This is just a Ponzi scheme to take your documents and 500 rs.

A Google user

5 years ago

This fraud company they are taking the registration fee to see the u r eligible for the loan or not. Kindly I m requesting to all please don't apply for this app. This is the fake instead of this u can apply for credit mantri they provide u all types of loan and credit cards they will help you without any cost.

Sanju patil Patil

1 year ago

This is a fraudulent app. I never took any loan from these people, but their account shows up in my CIBIL report with a delayed payment mark. This has drastically brought down my CIBIL score. Their customer support never answers calls. I have tried writing to the email address provided but never received a reply. This is so frustrating. I am going to lodge an FIR with the cyber crime cell. There is no other option left. I suggest everyone else affected do the same.

mahipat gohil

2 years ago

Very poor services. I applied for loan before 10 days. Still yet status stuck on processing. After contacting customer support they said we are unble to pay you. Cause have much application of loan. And for status update I have to sent mail then they will give reply.

Ashuthosh Lahoti

4 years ago

The app is in Beta mode since past 2 years months, Would it ever be developed? Coming to the investment part, there NPAs are very high. Forget about the interest, receiving even the principal amount is difficult.

Ravi Prakash

1 year ago

There is no option to stop further disbursement & proposals. How one can stop further investment & get their money credited to wallet? It will continue infinitely without any control of lender/investor. My money is stuck in this never ending cycle & not able to use my money when I need.

mukul varshney

4 years ago

Lending platform is not good at all. They show ads of 25-30% p.a. but that's just vague no. I have registered as an investor. Sharing the problems I face. 1. App don't work good in mobile at all. 2. They show the expected returns are 12% but when you are investing, it will give only half of it, that is 6% 3. In which, when you are investing, Rs. 20 and 1% of amount u invest is fixed as the app service charge, which surely brings down you return to around 4%. Lol Now think again before investin

Amit Kumar Sharma

5 years ago

App is good but it shows payments delayed where I never delayed a payment. I even paid the amount informing you guyz that emi was not deducted. We as a customer hope for the best service and in return we want you to update us on the issues. I never have a history of default payments . Edited :::: I have written to CEO and top management officials but they don't seem to bother about the quality of their customers. And many more things. They are not bothered abt anything.

Sathwik Vuppala

1 year ago

I don't have any loan from TRANSACTREE, yet it shows up in my CIBIL and also states that I didn't make repayment this lead to drastic fall in my score. Despite writing many mails, calling to customer care I don't have any response from your side. It's a useless service. A clear "SCAM", "FRAUD" company.

rohit rampal

3 years ago

Fraud app! I started with micro loan expecting returns as advertised, I didn't even get my principal amount back. Lot of defaulters, and the loan gets marked as NPA. Customer service is non existent, they charge the fee from you but your money is not safe.

Harsh Garg

4 years ago

Worst possible investment option. My money is stuck and is not credited to wallet for me to withdraw 1) Customer service does not respond. You can call them, email them do anything you want. 2) Wealth Manager chases you to deposit money, post that of you have any issues he blocks your number, switches off his phone 3) App does not operate properly at all, takes forever to load. You cannot trust the company and service at all. I will need to complain to RBI to get my money back from them.

A Google user

5 years ago

I have paid the necessary fee and tried to register with your application but it is not working and on the dashboard it says "in processing, our team will soon be in touch with you" but to my surprise no one ever bothered to get in touch with me. If you are not in a position to help me out then I request you to kindly revert the charges 500/- paid by me back to my original source of payment and I will close the account and uninstall your app.

Viswalingam Subramanian

4 years ago

I started with micro loans expecting decent return, with thousnads. I didn't even get back my principal amount. There are lot of defaulters. With so much default, why Lendbox is keeping this investment platform. This creates a doubt whether it is lending insider and defaulting. Other investment P2P company, well organised and no default. They don't offer atractive returns like micro loans. It is better for borrowers- no repayment required. Money is not guaranteed. Ended -ve return!

Atish Salunkhe

1 year ago

This app is fraud. Today, I checked my cibil & found something suspicious. It was showing that I have active Loan of Transactree which I have taken from Lendbox. And the hype was for me that I was reading these name like Transactree Lendbox for the First time. And I tried bt not able remove this loan account. It's Fraud.

Cyphr

1 year ago

This is a fraud app. I never took any loan from these people but their account shows up in my cibil with delayed payment mark. It has drastically brought down my cibil score. Their customer support never answers calls. I have tried to write to the email address provided but never receive a reply. This is so frustrating. I'm going to lodge an FIR with the cyber crime cell. There is no other option left. I suggest everyone else affected to do the same.