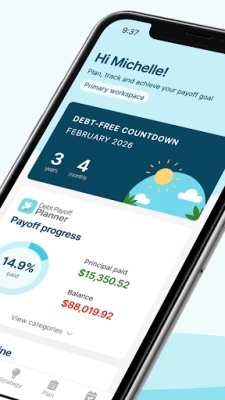

Debt Payoff Planner & Tracker

July 27, 2024More About Debt Payoff Planner & Tracker

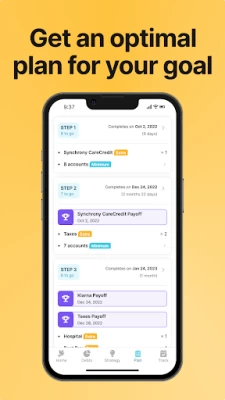

Easy steps to becoming debt free with Debt Payoff Planner:

Enter your loans and debts

Enter your additional monthly payment budget to pay down faster

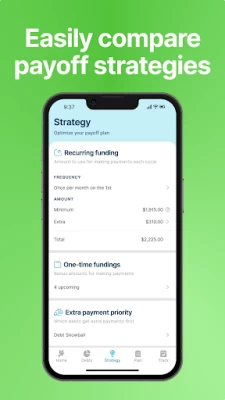

Choose a debt payoff strategy

☃️ Dave Ramsey's Debt Snowball (lowest balance first)

🏔️ Debt Avalanche (highest rate first)

❄️ Debt Snowflake (one-time extra payment toward loans)

♾️ Custom debt free payoff plan

Debt Payoff Planner and Calculator determines the optimum payment plan and how long it will take until you will be debt free. You tell the app how much you want to budget toward paying off your debt and we'll tell you how. We recommend the Debt Snowball strategy because we believe that paying off individual accounts faster will help you stay focused on your financial goal of debt elimination. A payoff plan is only useful if you stick with it!

Your ability and willingness to pay more than the minimum payments is how you will become debt free in less time than you imagined. Budgeting your income will help you to get a regular monthly amount to pay down the debt faster. The payoff chart will show two payoff scenarios: only paying the minimum amounts, and the repayment schedule when you pay more the the minimum ever month.

Additionally, there is an option to create an account for saving debt payoff and payment information. This account can be accessed across multiple devices, from multiple app stores. Creating an account is entirely optional, but it does enable you to have a secure backup and your information is immediately available if you start using a new device. Getting out of debt is hard, so we try to allow you to take baby steps toward this goal.

We believe that becoming debt free requires an easy starting point and making sure every dollar is leveraged perfectly. The loan calculator has minimal inputs in order to make your money management easy to follow.

The Debt Payoff Planner and Calculator is also used for tracking payments and updating the time-frame for becoming debt-free. Inputting payment information is as simple as typing in the amount and the date the payment was made. The goal of payment tracking is to see your progress over time and affirm that you are staying focused on your financial goals.

In addition to being a debt tracker and loan calculator, the apps points out some possible next steps with articles focused on how to pay off student loans, auto loans, and credit cards faster. Also, there are some tips on credit card balance transfers as well as strategies for debt consolidation.

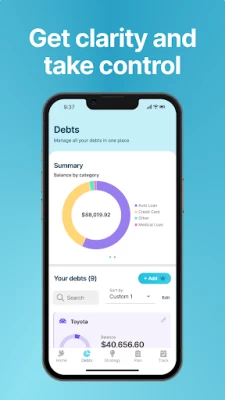

Eight different loan categories are available to help plan track and visualize your unique situation:

💳 Credit Cards like Capital One, Citicard, Chase, etc.

🎓 Student Loans like Navient, Sallie Mae, Great Lakes, etc.

🚗 Auto / Car Loans

🏥 Medical Loans

🏠 Mortgages like Rocket Mortgage, SoFi, etc.

👥 Personal Loans to friends and family or other individuals

🏛️ Taxes like IRS or local municipalities

💸 Other category could be anything from a paycheck loan to a hard money loan

In addition to the Debt Snowball calculator and the Debt Avalanche method, many users like to do a custom sorting of their debts. This customization is available for users that want to be their own debt manager.

Debt Payoff Planner supports Debt Snowflake payment as well. A Debt Snowflake is a one-time debt payment from things like a bonus at work, a tax refund, an extra payday, etc. This additional capability allows you to have tighter control over every dollar you are budgeting.

Latest Version

2.39

July 27, 2024

Easily get a plan and stick to it - OxbowSoft LLC

Finance

Android

620,852

Free

com.oxbowsoft.debtplanner

Report a Problem

User Reviews

A Google user

5 years ago

I love this app for holding me accountable to my debt. I didn't like having to add the payment and amount of interest paid every month though it actually helped me see how painful it is to have that much $$$ going out for interest. I also love the payoff date feature. I pay extra just to see it roll back. It's like a mini personal challenge. ❤

Wanda Leuck

2 years ago

I've been using this app to manage my budget and debt payoff. it's amazing. really helping me stay on track with managing my spending. helps me focus on my success of paying down debt with a realistic goal. I find myself checking on a daily basis. Best tool I've used in a long time. I did go pro so could see on multiple devices. It was only $24 a year, $2 a month. But there is also a free version!

Misawa Mandi

5 years ago

UPDATE: Lowering rating for now. Seeing interest rate & monthly payment at a glance was FAR more useful than a debt category icon. Pretty sure everyone already knows whether their debt is a car, mortgage, credit card, student loan, etc. WITHOUT the help of pictures. People tracking debt payoff via this app likely aren't 5 years old. Overall, a great app to track debts & total payoff times via snowball or avalanche method. Only a small learning curve to set up & use. I strongly recommend it!

Lauri D. Goldenhersh

1 year ago

This is not what I thought it was. If people are managing multiple debts and trying to coordinate how to pay those off, this is fantastic. I would absolutely go with this. But I was looking for something to help me track payments and interest on just one thing, and this doesn't really allow you to enter history or track payments. It just shows you what happens if you make payments according to plan. Perhaps I misunderstood it, but even the tutorial says that the only step is to enter debt.

Jay

2 years ago

This app really has opened my eyes to my problem with money. I can't thank the developers enough for this. The app is super intuitive and if you run into any issues they have a pretty story help section. Yeah you can use a spreadsheet and yadda yadda but it's pretty cheap and I feel well worth the money for a debt tracker. Side note this is not a budget planner. I use this alongside my budgeting program and it's been great.

Asad Ali

3 years ago

By far the most comprehensive, affordable and intuitive budgeting app that I have come across. Not only did this app bring clarity to my monthly expenses but it also gave a very clear plan to get rid of my debts. I was in a vicious cycle of making minimum payments with no change in my debt until I plugged in the numbers and the calculator did its magic. For $1 a month to streamline my finances, I can't be happier :-) kudos to developers

A Google user

5 years ago

I love this app!! I have all my debts listed and have put a snowball option on them, that shows me that I will be out of debt in 8 years ( including my house)! I never could figure out how to calculate that on my own. And entering new payments made is a breeze, I feel like I'm getting somewhere! I get weekly emails showing how much I have paid during that week and it's nice to see that amount because I never tracked that before. I love this app!!

KalaKoaKid 82

2 years ago

Just downloaded this app. So far i like the setup. Very easy to use and add cards. I love the pie graph. It helps me, as well as the users see what cards need to be worked on according to their preferences of the snowball/avalanche methods or chip away small amounts little at a time. I havent purchased the subscription yet. I wanted to see how the free version measures up to what the desciption says.

A Google user

6 years ago

UPDATE=2019 END OF YEAR , using app for incentive and goal setting on paying off debt!this has been THE BEST debt goal setter. Love keeping track of my credit card debt and seeing options to pay down. Just a great motivation. Alot is avail. for free version and I have used for about a year and never have issues. This has been a Game Changer for me! The App is amazing and awesome. Definitely a Top Notch Company and respectful of your customers. Your a great team! Thank you so much.

mandy cope

5 years ago

I like this app. I want to really like it. Just paid off 5 credit cards thanks to ut organizing. However, when I make a payment it adds what I had available to pay to the next debt for the same month! IE, I have one card I paid $699 on and another was for the minimum payment. Now it shows the one for the min. payment to be paid the min. plus the $699 this month. And instead of a Oct payoff, I now have a Sept. Take screen shots before entering payments. If it wasn't for this, I'd give 5 stars.

A Google user

6 years ago

I love that this is simple and can follow Dave Ramsey's debt snowball. I hate that it freezes every few minutes. I took me several attempts to get all my debts into the system. It would crash repeatedly with almost every entry. This morning, again, I am not able to update payments without it freezing up and hav in my to restart. I'm hoping this gets fixed because I really enjoy the simplicity of the app.

Susan Hazel

4 years ago

So I love this app, except for one very significant thing. If you consolidate debts onto a different credit card, for example for a lower interest rate, for a debt consolidation loan, it reads whatever you "paid off" as an amount that's available to throw at everything else. The debt has only been moved to a different account. But now #'s are off. I don't want to delete the old debt--like I have done previously - - because then I lose the proof of how much debt I've actually paid off. $138k.

A Google user

6 years ago

This app is great!!!! Highly recommend for those of us trying to go through a plan to get debt paid off. (FPU for example!) However, there are a couple of bugs in the application... 1. It tends to lock up. 2. There's something weird with the date when you edit the payments. It won't save the date unless you calculate or use the other option (which I can't remember what it is right now) within the edit functionality. Once you understand the issue, it's easy enough to work around though.

A Google user

6 years ago

The 'snowball effect' has been a proven debt elimination technique for decades. You can choose to either attack your debt service either by sorting from the highest APR or starting with the lowest running balance of a debt. It all depends on what your goals are. I only wish the feature of comparing both strategies side by side with what if scenarios and explanations why you would choose one over ther other were included. Perhaps a savvy developer of this app will see the benefits of it.

Candice Manglona

4 years ago

This is the best app ever!! I've been using it for a couple years now and the calculations are so accurate to paying down debt. Just submit the debt and details and watch yourself become debt free. The graph is also a cool feature, I like to know the ratios and seeing it keeps me motivated. It also gives you a step by step plan whether it's snowball affect or paying off things with the highest APR...tbh I wish I could give rate app this App #1 and the best part is its free!! Thanks stebt!! 😊

Megan Cummins

2 years ago

I've used this app off/on for years bc I love the easy navigation & that it didn't/doesn't require a subscription to use the basic features. With the current version, I find it difficult to add extra payments. Recurring payments are easy. I watched the video, which said to select the toggle to make an extra payment, but there isn't a toggle on my screen, so idk if that's a paid feature? I still give it 5 stars bc they do let you access the old version that's easier to do the extra payments.

David Ferguson

1 year ago

I'm liking the app. The debt tracker is not very useful to me, but I was able to find where I could just revise the balances in the debt tab. This simple option is not very conspicuously presented when someone is just getting familiar with the app. You should make this particular option more obvious for those who may like this style of debt management.

L. Carlson

1 year ago

I love this app except it lacks the ability to reset or place a hold on the plan on hold for when things happen and you can't stay on the plan for a month or too. Unexpected things happen to where you can't always stay on track but the app still continues on as if you stayed on track every month. The other thing I wish it had was the ability to link a bank account to accurately deduct amounts owed based on payments made.

Ruth Ann Buntin

1 year ago

Update: Interest doesn't calculate accurately & I always have to edit my balances. But it's still worth it. It's keeping me on track to pay my debt and save money. Wish there were more sounds and visuals when you make your monthly payments or pay extra on a debt. If you can, just do the Avalanche (highest interest to lowest) option. Even if you only have $20 extra to add, you will be amazed at how much money you are going to save in the long run.

Hunter Skillen

1 year ago

This app is great, but could use some improvement. For starters, it would be awesome if you could select multiple bills when marking something as paid, of you dont mark things paid right away you have to mark each item individually with a painful loading time for each one. Second, it would really help if we could track fixed bills as well, not just debt. Other than this, the app is fantastic and helps me keep track of all my (large) debt in one place.