Current: The Future of Banking

May 29, 2024More About Current: The Future of Banking

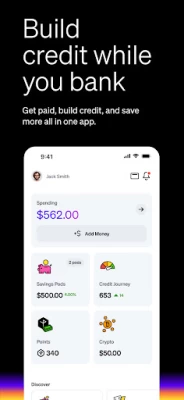

WITH CURRENT YOU CAN

BUILD CREDIT: Use your Build Card to build credit safely with every swipe, no credit checks required

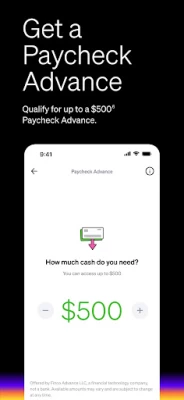

ACCESS CASH: Qualify for up to a $500 Paycheck Advance⁶

SKIP THE FEES: Get fee-free overdraft & fee-free cash withdrawals from 40,000 Allpoint ATMs in the U.S.¹

GET PAID: Payday comes up to 2 days faster with direct deposit²

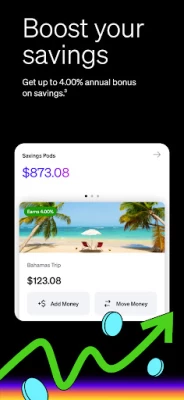

SAVE: Earn up to 4.00% annual bonus on your savings with a eligible payroll deposit³

GET REWARDED: Get up to 7x the points and cash back on swipes⁴

GET HELP: 24/7 support in the app

¹ Some fees may apply, including out of network ATM fees of $2.50 per transaction, late payment fees of 3% of any total due balance outstanding and past due for two or more billing cycles, foreign transaction fees of 3% of the full transaction amount (minimum $0.50), card replacement fees per card of $5 for regular delivery and $30 for expedited delivery, cash deposit fees of $3.50 per deposit, and third party processing fees

² Faster access to funds is based on comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct deposit and earlier availability of funds is subject to timing of payer's submission of deposits

³ Boost Bonuses are credited to your Savings Pods within 48 hours of enabling the Boost feature and on a daily basis thereafter, provided that the Savings Pod has accrued a Boost Bonus of at least $0.01. The Boost rate on Savings Pods is variable and may change at any time. The disclosed rate is effective as of August 1, 2023. Must have $0.01 in Savings Pods to earn a Boost rate of either 0.25% or 4.00% annually on the portion of balances up to $2000 per Savings Pod, up to $6000 total. The remaining balance earns 0.00%. A qualifying direct deposit of $200 or more is required for 4.00%. No minimum balance required. See Current Boost Terms at current.com/docs

⁴ Points available at participating merchants. Teen accounts do not earn points

⁵ FDIC insurance only covers the failure of an FDIC-insured bank. FDIC insurance up to $250,000 is available on customer funds through pass-through insurance at Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC where we have a direct relationship for the placement of deposits and into which customer funds are deposited, but only if certain conditions have been met.

⁶ Paycheck Advance is for eligible customers only. Your actual available amount will be displayed to you in the mobile app and may change from time to time. Paycheck Advance is a non-recourse product, not a personal or payday loan, and is not subject to any mandatory fees, interest, or APR. Conditions and eligibility may vary and are subject to change at any time, at the sole discretion of Finco Advance LLC, which offers this optional feature. Finco Advance LLC is a financial technology company, not a bank. See Paycheck Advance Terms at current.com/docs/

The Current Visa® Debit Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. The Current Visa® secured charge card is issued by Cross River Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. See back of your Card for its issuing bank. Current Individual Account required to apply for the Current Visa® secured charge card. Independent approval required.

Latest Version

7.3.1

May 29, 2024

Current

Finance

Android

5,174,741

Free

com.current.app

Report a Problem

User Reviews

bka59403@gmail.com

Bere Ka

1 year ago

Good

Chris Turnage

4 years ago

I selected a free account during sign up, except I was immediately issued a premium card and signed up for premium checking. Don't link your bank during sign up as you may be charged for the wrong account type! Edit: Support did indeed help me get my plan changed quickly, but the screen for selecting different account types hides the basic plan. When you do see the basic plan, there is no possible way to select the wrong one. There was no user error on my part.

Melanie Floyd

3 years ago

I get that as a newer bank there are going to be bugs. What I find frustrating is not having my questions answered (usually outright ignored) and constantly being told to reinstall the app to make it work (spoiler: it never worked). Their customer service was prompt and seemed nice, but also severely under trained—when I decided to close the account I was told I could not do it through the app, but I could use email or chat (which is through the app). There are not enough characters to finish.

A Google user

5 years ago

I had no problems with the app or the account at first. Then, I upgraded to premium. I never recieved the card I was paying for and every time I reached out to support, all they had to say was that i shouldve definitely recieved the card by that point. I waited for two separate cards after having to reorder it after it never showed up. No real help whatsoever. Just the same response every time. If you choose to use this app, I would stay basic.

AceBreakz

4 years ago

So far I've had a good experience using the Current app. The only thing I've had issues with is the customer service. I've had excellent knowledgeable, helpful agents, and agents who are ignorant AF! Overall, I like the product that Current offers so I do recommend it if you're looking for a mobile banking app that offers a debit card, real checking account you can actually link to other accounts, and many free atm services.

Kimberlee Silversmith

4 years ago

I signed up with Current back in October and I chosed to have the premium account. I pay $4.99 a month to get paid 2 days early. So far I haven't had any issues with this company! Plus you get points for using it at certain locations and there's no withdrawal fee when you use certain ATMs through the app. I'm giving it 4 stars instead of 5 because of the $4.99 fee to have a premium account instead of a basic account.

Haley Olivia Neal

2 years ago

Current has been my primary banking app for the last 2 years, and I don't plan on switching to any other banking app anytime soon. My credit needs quite a bit of work, that's why I now have Current's Build card! Overall I have been super impressed and happy with Current's improvements and changes throughout the years, there's a reason I've stuck with this banking app for so long! *I've been experiencing a glitch for a while now where the app automatically logs me out and I have to log back in.

Tyler Schultze

4 years ago

Signed up quick and easy, but swiped to start with a basic account and not a premium, and didn't select it, I thought just by swiping it would change but you have to select it. Anyways, contacted support when I got in the app and within a minute Nathaniel popped in to chat, read the issue and had it changed in a matter of minutes. Absolutely the best customer support I have ever received from any app or online service. I could care less how the app works now lol.

Corina Okeeffe

4 years ago

Best bank I've ever had! They don't make you jump through any hoops the app is easy to use and stress free all the way! I love current they are everything you would want in a bank and more !!! Highly recommend ! I had been looking for a mobile bank app and was frustrated by how many of them just ended being huge waste of time just throwing obstacles left and right to make it difficult to do anything you need to do . CURRENT makes it just easy and just hassle free. So impressed thank you guys !!

Roxanne Mitchell

3 years ago

The card they sent me is super cute, and I like the fact that I don't have to set up separate savings accounts. I just save on the same account, and I can organize what I'm saving for. I also love the points rewards system. Edit- I'm not liking the new update. While I do like that it takes longer for me to take money out of my savings pods (it's been really hard for me to save), the app won't let me put anything in my savings pod. The "next" button is grey and unclickable.

xochitl valerio

2 years ago

It's a pretty great app. It's been a good alternative after Simple and One :( However I wish they had pockets for monthly expenses. The pods are great for long terms savings. It's a bummer they cut down the APY to 0.25% if you don't have automatic direct deposit. It would be great if you had a certain amount of money and maintain it you would still get it the 4%. We can't have everything I guess. I do see that people don't get spending alerts, I've never had an issue.

PrimeAegisLink

2 years ago

I really enjoy the app. Would like if the layout was a bit more spaced out. Like having the savings pod on a different screen or lowering the apps main screen. Also, it would be great if the pop-up in the apps main screen would take up less space. They get in the way when navigating the app. Furthermore, the app doesn't always display a notification. Finally, my biggest reason is my debit card, oftentimes, is randomly declined even with plenty of funds and even with a correct pin.

A Google user

6 years ago

1) Didn't realize there is a annual fee. 2) You can only have one "savings pod" with the basic account but you can upgrade the account for more pods. 3) The app isn't intuitive. I have Simple right now, these features are free with them. What is driving me away from Simple is that they no longer do online bill pay where I am able to mail checks directly from the bank. Overall, Current isn't what I'm looking for and I will continue to wait for Revoult.

Doc Experior

5 years ago

Was pretty curious about this app, looked cool, thought I would give it a try. Upon creating a account, I specifically picked the free one in order to go through the app and see what there was. However, after selecting that and going through the app for a bit, realized I was put as a premium account, the paid version of Currents banking. There is no easy way to change it, it would seem, and I cannot trust a company that does something like that. Especially with my money.

Shaianne Thompson

2 years ago

The app is a great experience, and banking with current, for the most part, was pleasant. I loved having the $100 overdraft limit for when my paychecks just couldn't stretch out until the next one, and getting an early payday! However the cons of this bank have made me go to capitol one; For starters, making large purchases such as for a car or housing is nearly impossible with the limits that they set to access your own money, and they make no exceptions. Also, I used to be able to deposit cash

Jacob Valentine

1 year ago

Good banking app except the fees to deposit money. Kinda BS but I don't deposit cash that often so I'm not that upset about it. One thing tho, th build credit card has dropped my credit score 114pts! All I can figure out is that SOMEHOW the credit reports see the payment as still owing a balance even though it's already paid! I did some research online and that's all I can figure out. I'm gonna stop using the card and see if that makes a difference. If it does, I'm literally going to sue y'all.

Beautiful Heartt

1 year ago

Probably Would have rated higher if the app's credit builder card actually allowed you to use credit and pay it back. It definitely does not. I honestly want to give the rating a one star. Because every single time I use my debit card at anywhere. It declines when I have funds available. The response the register gets is This transaction was declined by your bank contact your bank. When I contact obviously there's nothing wrong. It is like an automatic system that constantly declines the card

Anomaly

1 year ago

Sat on this for a while hoping it was just a bug with the app. Used it for a minute and never had a problem until the beginning of this year. Won't let me log in, keeps saying session timed out and to log in again. I do that, even wait a bit, even uninstalled and reinstalled. It also won't let me try any other way to log in aside from my number either. Not a problem w the card being expired bc I can still be sent money and subscriptions still draft. Can't even open it and contact any support.

Christina Wallace

1 year ago

Current is the best prepaid debit card and banking app I've ever used! I love it! I use it to get paid for all my jobs via direct deposit and I always get paid and have access to my paycheck a day or 2 earlier than my coworkers. I love all the features and perks such as my FEE-FREE over draft! I have heard so many horror stories from friends about having to pay huge over draft charges for each purchase, but not with Current! They also offer paycheck advances! It's so easy and I love it!

Cary DuBois

1 year ago

I've had this account for almost two years and it's so good with security and the ability to manage your spending and what you can save . It allows you to block certain apps and helps with subscriptions. well it helps with management of your whole account. allows you to build your credit with its build credit card and get an advancement with direct deposit- depends on your direct deposit amount. but overall an exceptional app. I'm pleased and secured.

Eric

1 year ago

I love Current, I have been a customer for 4 years! 😁 Current is wonderful. The mobile app is amazingly designed. They have some great features I enjoy, such as the minimum cash deposit of $5.00 instead of $20.00 I also love the fee-free overdraft and cash advance as well. The credit builder card is phenomenal, and I adore it. However, I would love to see it report to all 3 major credit bureaus instead of just Transunion. It's a great app & bank!