Albert: Budgeting and Banking

June 03, 2024More About Albert: Budgeting and Banking

Albert is not a bank. See disclosures below.

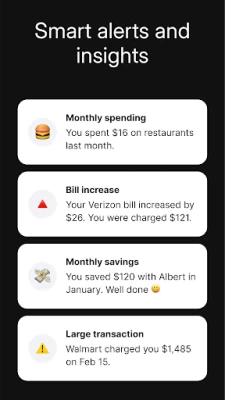

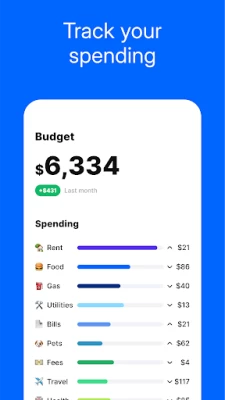

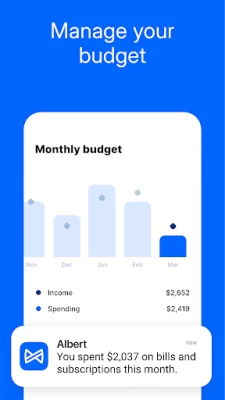

KNOW WHERE YOUR MONEY’S GOING

• Manage your monthly budget

• Personalized spending insights

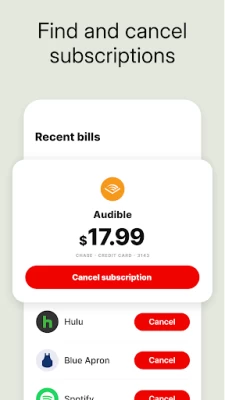

• Track bills and subscriptions

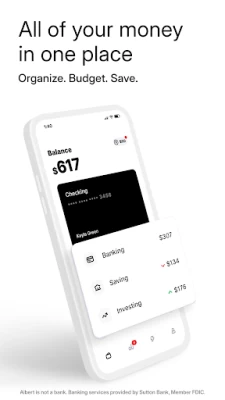

• See all your accounts in one place

BANKING WITH GENIUS

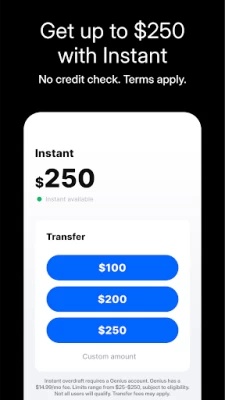

• Overdraft up to $250

• Get paid up to 2 days early with direct deposit

• Earn cash back rewards

SAVE SMARTER

• Automatic saving

• Create and track goals

• Earn cash bonuses

GUIDED INVESTING

• Invest automatically

• Buy stocks and ETFs

• Managed portfolios

PROTECT YOUR MONEY

• Identity protection

• Credit score monitoring

• Real-time alerts

DISCLOSURES

Banking services provided by Sutton Bank, Member FDIC. Savings with Genius and Albert Savings accounts (together, “Savings”) are held for your benefit at Coastal Community Bank, and Wells Fargo, N.A., Members FDIC, respectively (together with Sutton Bank, each a “Deposit Bank”). The Albert Mastercard® debit card is issued by Sutton Bank, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds in Albert Cash and Savings are held in pooled accounts at their respective Deposit Bank and each are FDIC-insured up to $250,000 on a pass-through basis. Your FDIC insurance for each such account is subject to Albert maintaining accurate records, a positive determination by the FDIC as receiver if a Deposit Bank should fail, and with respect to each Deposit Bank the aggregation of all of your insured deposits held at that Deposit Bank. Albert Investing accounts are not FDIC insured or bank guaranteed and involve the risk of loss.

The Albert Subscription costs $9.99 per month. Try it for 30 days before you're charged. The Albert Subscription fee will auto-renew until canceled or your Albert account is closed. Cancel any time in the app. The Albert Subscription does not include all Albert features. See Terms for more details.

Genius, which includes Albert Cash, Savings with Genius, and all features offered by the Albert Subscription, has a maintenance fee that costs $14.99 per month. You’ll be charged 30 days after signing up. Deactivate Genius or close your Albert account any time in the app.

With Instant overdraft coverage eligible members can overdraw their Albert Cash account for debit card purchases, ATM withdrawals, and transfers. Limits start at $25, are reevaluated on an ongoing basis, and are subject to eligibility requirements based on your linked bank account activity, and other factors. Not all customers will qualify. Fast transfer, ATM and other fees may apply.

Brokerage services provided by Albert Securities, member FINRA/SIPC. Investment advisory services provided by Albert Investments. Investing accounts are not FDIC insured or bank guaranteed. Investing involves the risk of loss. More info at albrt.co/disclosures.

Credit score calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore 3.0.

Latest Version

9.0.20

June 03, 2024

Albert - Budgeting & Banking

Finance

Android

7,275,179

Free

com.meetalbert

Report a Problem

User Reviews

Hanna Miecznikowski

1 year ago

This is SO difficult to use! Things that should be intuitive and obvious are not. Plus it is purposefully deceptive, making it look like instant cash is easy to access. However, there are SO many layers and delays. Other apps work much more simply and straightforwardly and offer the same function. Also, everything takes forever... The auto save feature pulled money out of my account before I realized I needed to disable that. When I tried to put the money back, it took longer than 10 days...

Daniel

1 year ago

Albert is a predatory service akin to payday loans, but way worse. Paying the balance isn't enough to get rid of them. Had to change my bank account number to be rid of it. Requests a tip for a simple automated account to account transfer. If you don't want to tip, you have to figure out how to change it to zero, which is touching a completely unmarked portion of the screen. Which is weird after having to hit custom amount. I just shut down the app for a long while until I just realized how. Pro

XtremeKritik

1 year ago

The app automatically turns on auto saving and takes your money but you have to upgrade the account (pay them) to withdraw the money. It shouldn't be accessible feature to an unupgraded account to take the money in the first place. They have just over $100 of my dollars. It's worse than I thought, you CANNOT cancel your account until you pay them to withdraw the money they took from you.

Big Holly

1 year ago

App is a scam. My entire experience with the app has been horrible. The app won't allow you to withdraw or transfer your money into your account after they put into your rainy day fund. And after providing all the screenshots of the issues that I am having customer service emails me the same steps over and over that I have have already done and provide screenshots of. I DO NOT SUGGEST THIS APP FOR ANYONE. My issues are still not resolved. And you can only contact via email or text. No calls

Kenny Roberts

1 year ago

I do not recommend this app. Use other apps before this one. Suspending my account even though made payments on time. And then it charged my account fifteen dollars for a monthly fee that I never approved. And transfers money from a linked bank account to a albert savings account that it automatically signs you up for and adds a monthly subscription. It is impossible to remove any linked accounts to. It will not let you delete your account either so it continues to charge you a monthly fee.

boi wonder

1 year ago

It's unreasonably difficult to close/deactivate my account. I finally found out how to do it but when I get to the part where I enter the last 4 digits of my bank card, it constantly says that they can't validate my card even though the number is correct. It really feels like this app does everything it can to make sure you don't unsubscribe, because if you unsubscribe then they aren't getting your money.

charles thorschmidt

1 year ago

I signed up months ago just to apply, jumping through endless verifying my personal debit card will never "link" while micro deposits /withdrawals continued just fine on my bank side. Their $8 "genius" fee verifies. If trying to obtain a small payday type advance, you will sign up for a "rainy day SAVINGS fund" that also MUST have NO $ in it to cancel. They take a few $ for the fund & make it hard to zero the balance. You literally have to stop them from taking your $ to cancel, & it's not EZ!

Brittany Blazer

1 year ago

It started off fine but then after a few months of using the instant loan feature is says that I'm no longer eligible even though there has been no changes to anything that would cause that. I tried to ask customer service about it but they just dodge the question and instead spew general information at you that is completely unhelpful. They won't actually tell you why you all of a sudden don't qualify anymore. Also It takes like a week for them to take the money to pay it back. Very annoying.

Dominic Quintana

1 year ago

The app immediately signed me up for some sort of savings program that I do not want. There's no clear cancel option on this unwanted feature. Asked me to start a free trial so that I could seek the cancel feature. I didn't want that either. I called customer support. There is no human there. They only direct you to use the app. Which again has no way of canceling through the app. I have texted customer support with no response. I have emailed customer support with no response. ZERO STARS!

Selena Simmons

1 year ago

This app used to be dependable. But now, with the new "update" I cannot even get approved for a cash advance. I have been using this app consistently for almost 2 years with no issues. I have sent the invite friends to many of my contacts. I had $26 in savings that the app wouldn't let me withdraw because it said it "couldn't validate that I was the bank account owner" I had to go through customer service and they were able to withdraw it from their side to my bank account. I'll be deleting.

Adam Goebel

1 year ago

Terrible. After being away from Albert for a while, I logged back in. The first time, it took me to the home screen and asked me to start the $14.99/MO free trial. Then when I reopened the app...it asked me to link my bank account again. When I did that, it said "successfully linked" but wouldn't let me continue. So they're robbing me of $14.99/mo and now I have no way of canceling it.

Jenna Turner

1 year ago

This app has potential if it didn't bombard you with upgrades and sign you up for some rainy day fund that you can't opt out of. All of the features they promote are actually an EXTRA upgrade. I was looking for something comparable to MINT but this app isn't it! In the first two weeks it decided I had $49/wk to put into this rainy day fund and there was NO WAY to opt out without contacting support. The text support is quick, helpful and responsive. Hence 2 stars. Sign up at your own risk!!

Violetta Maddox

1 year ago

Do NOT get this app if you're struggling with money. Once you agree to the subscription, it is very hard to cancel it. First they said I needed to verify my debit card number took forever to find out they meant THEIR debit card they never sent to me in the mail, finally sorted that and now I can't close the subscription until all of my balances have been withdrawn. It shows I have $3 in investments but when I attempt to withdraw it, it says I have $0. So now I'm stuck reaching out to support.

Adam Zangara

1 year ago

Use only in absolute emergency AND be prepared for repayments to happen when you least expect it and even if you have like $24. They'll take $23. You MUST have fully $0 balance to close acct which can take a few days (if you manually pay back, or takes about 5 days. If it's automaticly deducted, it's instant. So, if you cancel, make sure to do it as soon as your balance is $0. Their customer service is actually pretty darn good and very responsive. That's why I gave it an extra star. Text only

Kristy Aguirre

1 year ago

Missed one payment because it takes FOREVER after you make a manual payment, by the time it went through, the money was gone. Now after consistently paying on time for a year, and having a positive Albert balance (I overpaid by $10) I don't qualify for an advance. Look at the customers payment history before making them unable to qualify, and get a better system where our manual payments go through immediately. Sadly, I'm going to cancel this service. Bye Albert.

Jay Biassi

1 year ago

Got this app for Instant coverage and for the first 3 months it was available but then all of a sudden, no more instant coverage and I meet all the criteria. Unfortunately, the only way to get through to them is through email and I have never received a response back yet! Plus the $14.99 a month fee just to have access to instant Is absurd. To top it off you must have Smart Money turned on. That gives them access to your primary bank account which they can move $ from at will. Low key scam.

Ronnie

1 year ago

This app was designed in a way to make it really hard to cancel. Ive been trying to cancel my account for weeks now after paying back my advance. The payment is still pending after 10 days and they continue to take money from my account because of some bs feature called smart money which takes money from your banking account and puts it in a Albert savings account. It's a set up and they depend on you being desperate enough to continue to use there app. I would avoid this app

Jessica H.

1 year ago

Do NOT get this app! It's absolutely awful. My paycheck was late showing up and when I contacted customer support, I was asked to supply a check stub, which I don't have because I have direct deposit set up. Also, to transfer money from the Albert app to any other account is 4.99 per transaction. And you can't transfer more than 500 per day. I wanted to transfer my entire check to my other bank and just be done with it but I can only transfer 500 per day, with a 4.99 charge each time.

Clara Carlson

1 year ago

Canceling the account is unnecessarily difficult, and in fact, after emptying all funds somehow on the day I was finally able to cancel, a random $.39 showed up in my account. The price had become excessive, and yet despite giving me a breakdown of all purchases and subscriptions, what I paid them never showed up in my spending summary. I had no idea the annual cost went from $48 to nearly $180! They'll probably charge me for May, doesn't matter that I'd been trying to cancel since mid-April.

Two Octopusses

1 year ago

Normally the repayment is automatic & will be taken from my account & reflected usually the same day as the repayment. Recently when I checked repayment it wasn't automatic and showed that I didn't have anything in my main account after talking to 3 genius's I had to add my account a second time & now the repayment is pending but now it's going to be 3-6 days for it to clear. Yet their monthly subscription is taken from my account and processed almost immediately every month With no delays.