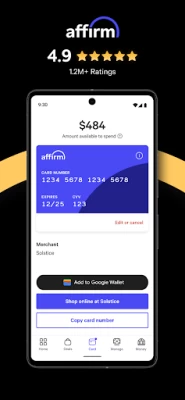

Affirm: Buy now, pay over time

June 18, 2024More About Affirm: Buy now, pay over time

• Pay over time at almost any store

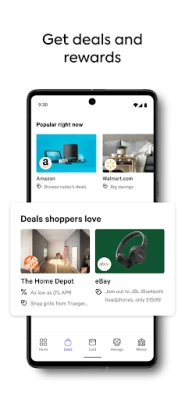

• Get access to exclusive deals and rates as low as 0% APR

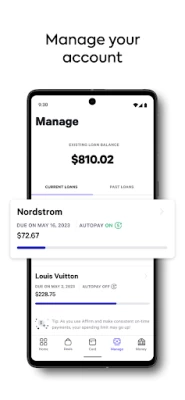

• Manage your account and make payments

• Open a high-yield Affirm Money Account with no minimums and no fees

Take your Affirm Card with you everywhere:

• Use your Affirm Card online or in person

• Planning a big purchase? Request a payment plan in the app before you head to the store

• If you’re shopping on the go, you can link your bank account to pay with your card almost anywhere, or use the app to request to pay over time for eligible purchases after you swipe. Minimum purchase may be required for payment plans. See footer for additional details.

Shopping with Affirm is simple and easy—browse your favorite stores online or in-store, choose the payment terms that work best for your budget, and complete your purchase at checkout or with your Affirm Card.

The Affirm Card is a VisaⓇ debit card issued by Evolve Bank & Trust, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Pay-over-time plans must be applied for each purchase in the mobile app, are subject to eligibility checks and are provided by affirm.com/lenders. Minimum purchases are required for pay over time plans; the amount is located in the Card tab of the app. For purchases that are not approved for and matched to a payment plan, you authorize Affirm to initiate an ACH debit from your linked bank account within 1-3 days of the purchase. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses.

Rates from 0 - 36% APR. Loan options vary, are subject to eligibility, and may depend on whether your loan is applied for before or after your card purchase. There are minimum purchase amounts for loans, a down payment may be required, and may not be available in all states. The Affirm Money Account is held with Cross River Bank (CRB), Member FDIC. Affirm is not an FDIC-insured bank. FDIC insurance covers accounts held with CRB in the event of a CRB failure.

Latest Version

3.261.4

June 18, 2024

Affirm, Inc

Internet

Android

10,400,552

Free

com.affirm.central

Report a Problem

User Reviews

Christian G.

1 year ago

Creates account, days later gets & uses virtual card, then checks credit, "Our partner bank can't prequalify you because of the length of your credit history. Our decision is final."? So you can get a line of credit without a credit check?🤣 Where's the sense in that, & where's it in removing the credit I got prior to the check, cause I sure don't see it? TL;DR Don't check your credit if your history's short; they're fine with giving any credit-less bum a $1200 credit line for some reason.🤔🤷🏻

Cheryl Alvino

1 year ago

Just started Affirm with this first purchase with Temu..I can't really rate yet, I just made my first payment. The app seems easy, it's easy to understand and love the fact that they text you with all details of your agreement, but ESPECIALLY bc I get to make one payment MONTHLY..with Afterpay, you have to make TWO payments a month! The interest isn't bad, it's doable..I'm sure I'll be using this App a lot!

Robert McPherson

1 year ago

Affirm has been a fantastic tool for big purchases and rebuilding my credit. I have never had any issues with the app or Affirm itself. Easy to use, convenient, secure, and clear, simple instructions and payment details. It is easily a top recommendation for anyone who is unable (or unwilling) to make purchases in one lump sum and/or those looking to build or rebuild their credit history. It has especially been a life-saver on larger purchases, such as replacing or upgrading electronic devices.

Kenny Adam

1 year ago

Excellent source of Financing needs from various purchasing locations. It's easy, afforable and genuinely for everyone. No matter what's needed, where you purchase it, generally Affirm is there. It's definitely a great way to buy now and pay later. It's for you and they work for you. Very easy. Payments are usually made a few weeks after the purchase, which sometimes makes things easier. To be able to have A 3 or 4 payment plan option makes things super easy as well. Forever Grateful to Affirm.

Christina “Boo”

1 year ago

I love Affirm! I dont have the best credit score, I hesitated on applying for Affirm. Every day, I would go to stores & look at all the items I could buy, but I couldn't. Then, one day, I was curious and checked out with affirm, and surpriseingly, it went through. I picked a plan and was super excited that i could get all my items from my cart and have affordable monthly payments. I love it and am looking forward to using this service even more!!

daniel covey

1 year ago

Easy payment options with very short terms. Updates the credit amount with payments made. I find this app/service very straightforward and easy to use. Shows total with interest and updates the total and interest remaining when you pay more than the minimum. This has been nothing but awesome and I recommend affirm to my family and friends.

Kenneth Smith

1 year ago

Doesn't notify me until payment is almost late. I pay all my bills 1 month early as soon as the statement comes out to allow for a 1-month buffer in case of emergency. I almost missed a payment because this app doesn't notify until the day the payment is due. Not sure if Affirm benefits from late fees, but this seems a little shady. BTW I have all notifications boxes checked and permissions set to allow on my phone. Probably won't be using Affirm again after this is paid off.

Rebecca Miller

1 year ago

It's easy to understand exactly what I want and how I want to use my credit as far as buying and payments go. I like that it gives you the opportunity to pay upfront or payments and helping build your credit as well as earn more money from them to do whatever I need whenever I need and having the option of using it on my in store order to.

Charlie Burnside

1 year ago

I love the affirm app. similar to using a credit card, but the interest is way lower. You can choose different payoff plans to even have no interest. You get deals at retailers and its easy to check your payments and get alerts. I have used it for 3 years now. I highly recommend it if you are tired of credit cards. I basically use it for purchases that I have the money for but would rather not pay the whole chunk at once.

Matthew Horrocks

1 year ago

I definitely recommend Affirm. Affirm has been a really good credit tool for me. I don't do well with standard credit cards. With Affirm I know the purchase has a specific number of payments and I know before I agree how much interest will be in both percentage and dollar amounts. So you can decide if the purchase is really worth it. Some purchases qualify for 0% which is fantastic. Its allowed someone with limited income the ability to get items that otherwise might be out of reach. Thanks

Christopher Schwartz

1 year ago

I cannot log into the app at all and thus cannot use affirm at the point of sale. I've contacted support, have troubleshot the issue, and if has not been resolved for months. I've heard nothing back from support at all. Highly disappointed. Update : Contacted support and received no help. I haven't been able to open the affirm app on Android for over 6 months.

C Murray

1 year ago

Great app and great tool for making periodic payments. The autopay feature is exceptional, as is the ability to go in and pay things off early. I would definitely recommend to the developers that they add a feature where you could check off multiple purchase payments to make all at once, and let that hit your bank as one payment, not multiple. Some of us with cheap bank accounts have a daily transaction limit, and I periodically hit mine by making batches of Affirm payments on payday.

M Delgado

1 year ago

Love Affirm app better than klarna. I use it all the time. Easy to place your orders or book for hotel stays and etc. Their payment plans are extremely reasonable, and interest rates are always accurate. Their virtual cards don't expire on purchase like klarna does. Also, it's easy to get in contact with customer service, and agents are extremely friendly and helpful on any questions you have. 100 percent satisfaction.

Xina Moira

1 year ago

No fees for paying off early. Fees in general are pretty minimal. I'm fine with paying $11 extra bucks to not pay $300 all at once. Not to sound too corporate-y, but I think of it like this; that 11 goes to everyone that runs the service. And if I don't want to pay extra, I don't have to. They have 0% APR on certain packages, which imho are reasonable. Like paying $30 for 3 months or something with no extra charges, just the amount of the item you purchased. A very human, and *humane* service.

Couri Jones

1 year ago

Convenient, straightforward and definitely handy when security is of importance. Use Affirm as a payment method and avoid using your personal account information. Plus, it can help those that need a little more time to pay. Just use responsibly and your "Spending Power" increases your purchase power...(higher credit limit). Option to pay off early of course. Great app.

Adahy Lewis

1 year ago

Affirm has helped me get several high price items that were needed at times when paying the full lump sum was not possible. Headlights for my truck, done! New handheld device, done! Going to keep them in mind for the future. One thing to keep in mind for anyone: it can be really tempting to keep getting things. Instead, pace yourself so the monthly pay amounts aren't too much.

Thomas Mack

1 year ago

The app is extremely buggy. "Check your buying power" gets stuck in a loop and the only way out is to kill the app. Sometimes your list of accounts under manage doesn't load properly, so it says you owe nothing. Outside of the app, I get random emails a month after I paid sometime off. Same with payments made, or any email really. Not really sure what affirm is doing but the service is getting worse.

Luke Rianoshek

1 year ago

Probably should be careful how I rate this as it has made purchasing "stuff" a lot easier, but has slowly increased my debt over time, but that's a ME problem. Overall though, great app for making those larger purchases less scary. I usually opt to pay a small chunk up front and then have 3-4 payments every couple weeks. This usually makes the purchase the exact same price with 0% interest. Or pay a small amount of interest and stretch the payments over 6-12 months. Great app!!!

Sean Brewer

1 year ago

Using the app, itself, is great. Easy to use and fast. The ability to make time sensitive small to medium priced purchases and pay over a short term is terrific. For example, I was able to buy $350 worth of weed and feed in February, when I needed it) and make 3 monthly payments to pay it off by May (when I had the money). Cost me $45 to do it.

Erick Marquez

1 year ago

The app is fine. The way to pay, setting up automatic payments is easy, changing payment source for payments is quick. App is good. Some check out issues, but that's everywhere! The the way this company determines purchasing power is putrid! My mom and I have paid more then 72% of our outstanding balance in 8 months, I thought they would want to keep us around. Nope, no offers, no deals, nothing, purchasing power is miniscule. Almost $11,000 paid off, and no loyalty! Really strange!